Ross' financial disclosure (form 278e) [PDF \ 57 pages]

Ross' ethics agreement [PDF \ 9 pages]

>>> Nominees for high-ranking positions in the government are required by law to disclose their financial interests. The Office of Government Ethics quietly posts these forms but only for the highest-paid positions.

Here we have the financial disclosure and ethics agreement for Wilbur Ross, Trump's nominee to head the Department of Commerce.They're above as a PDF, with the most important pages from the disclosure below as images.

The typical financial disclosure form for a Cabinet nominee is 12 pages or less. Ross' is 57 pages.

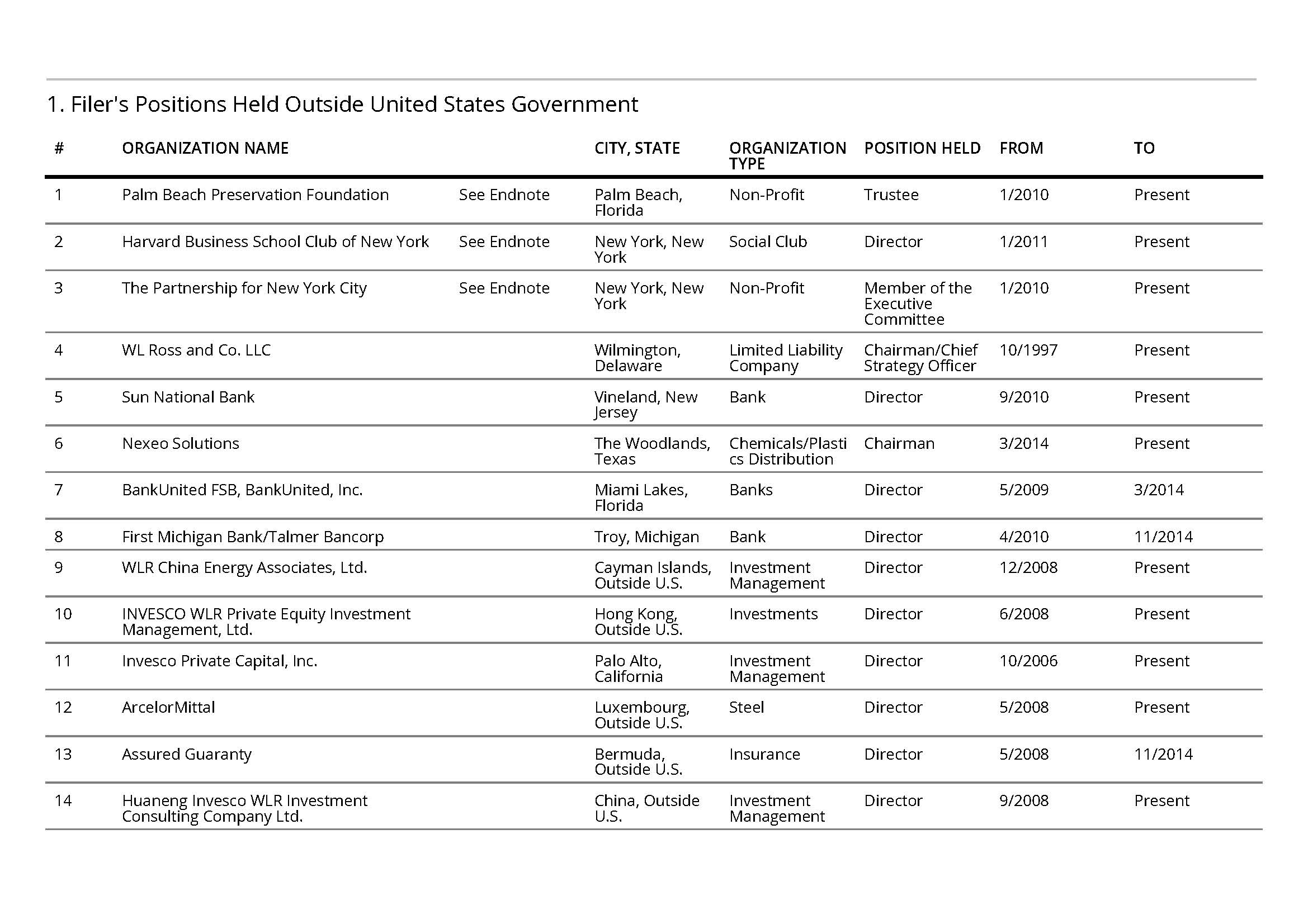

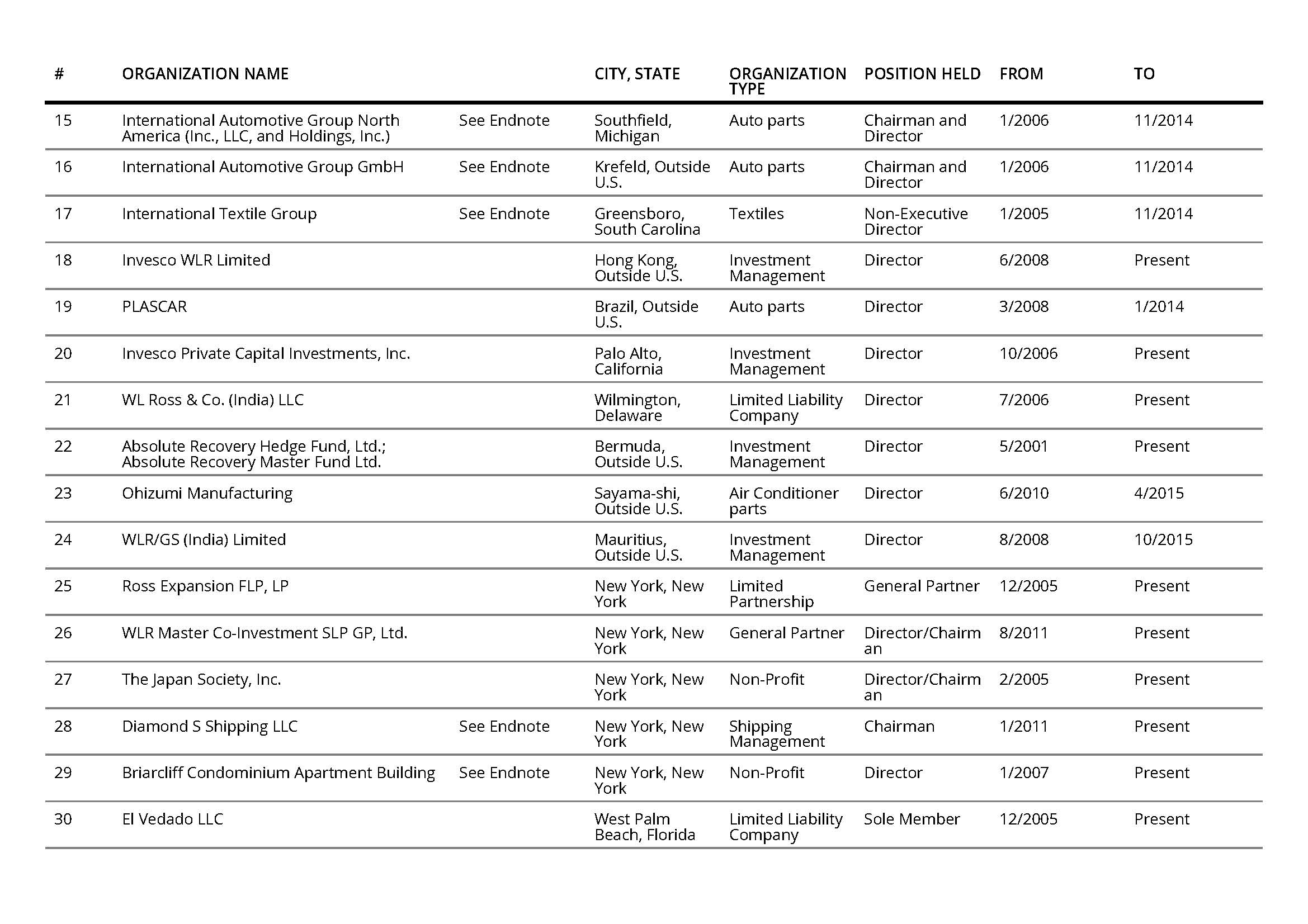

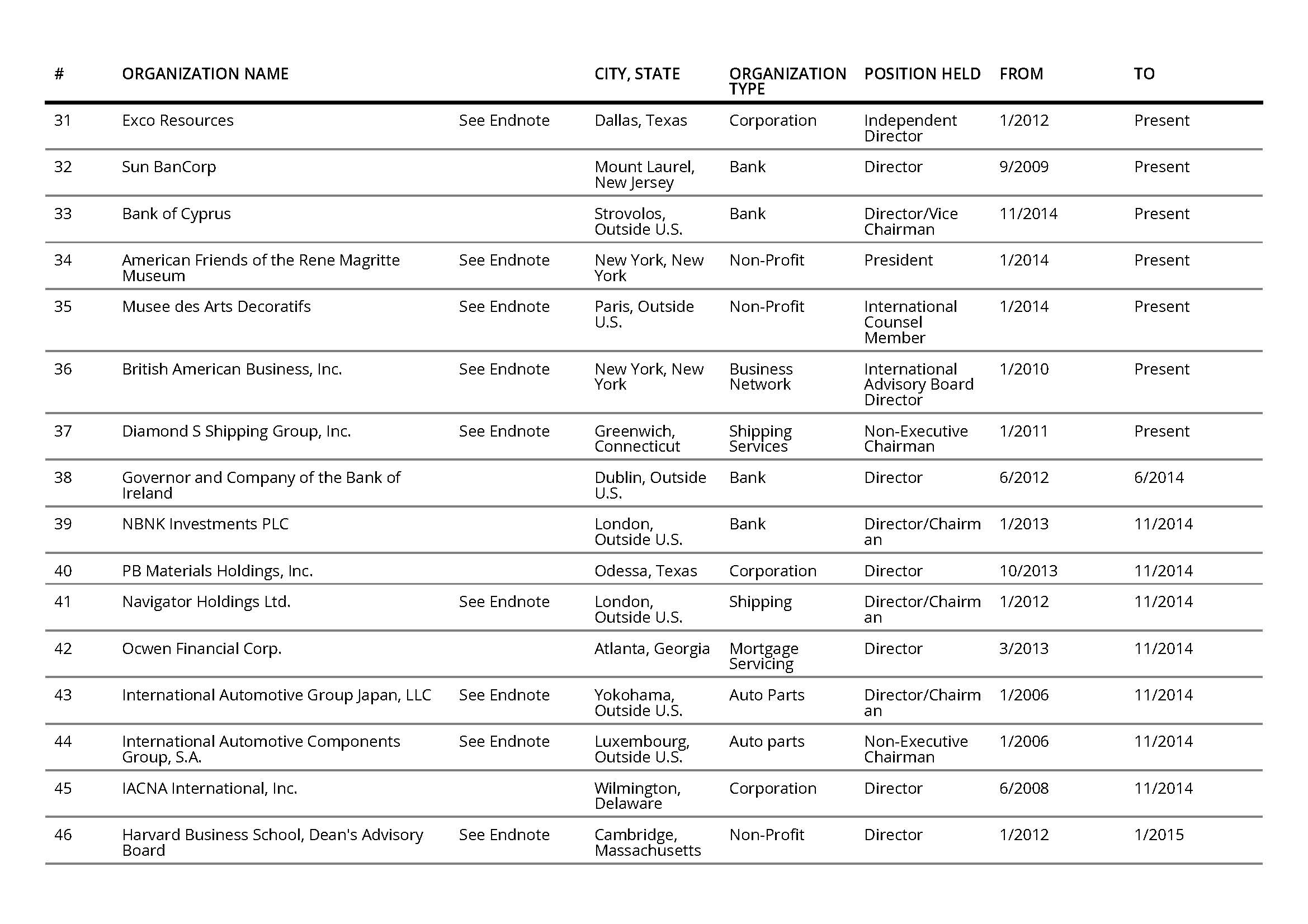

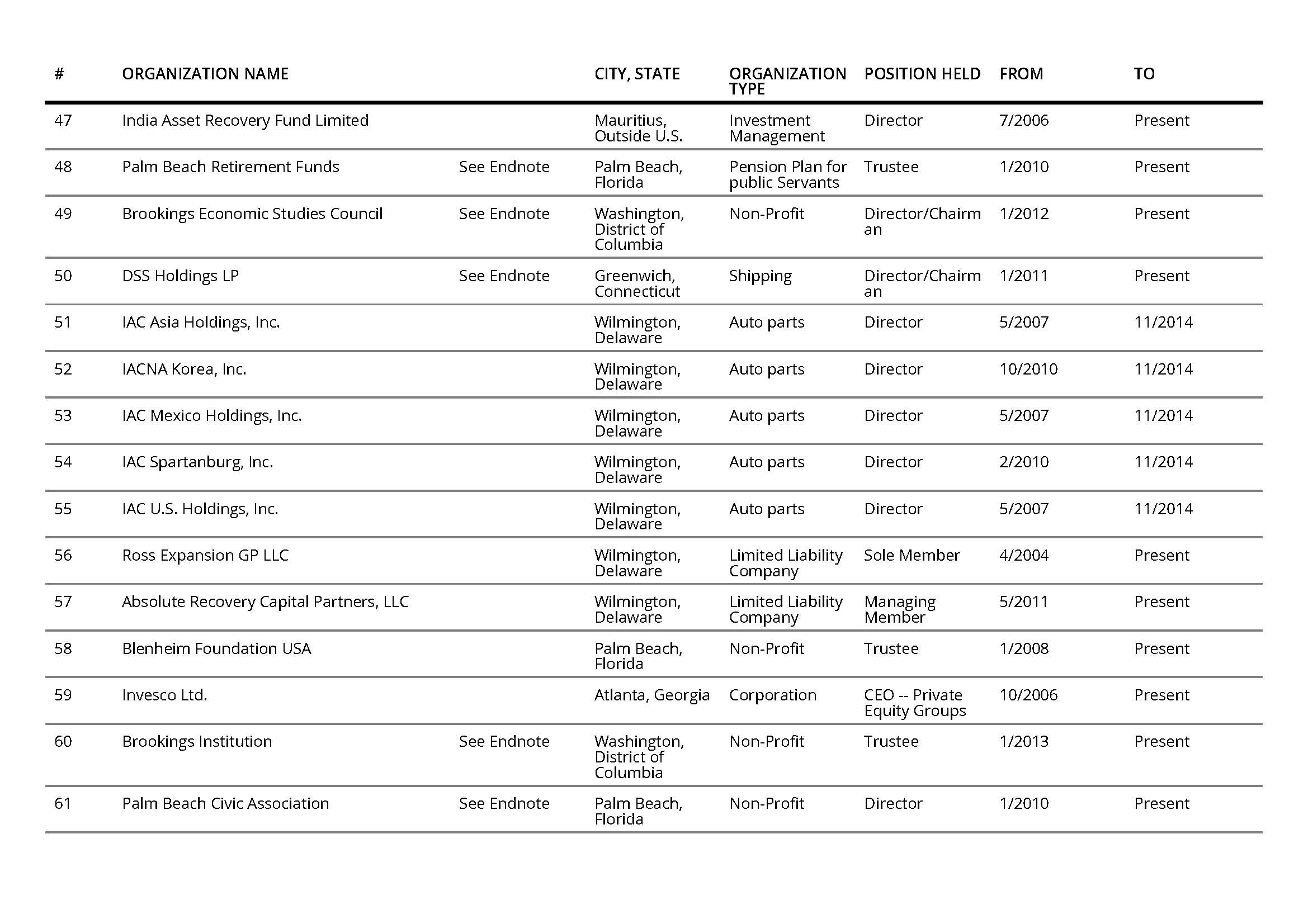

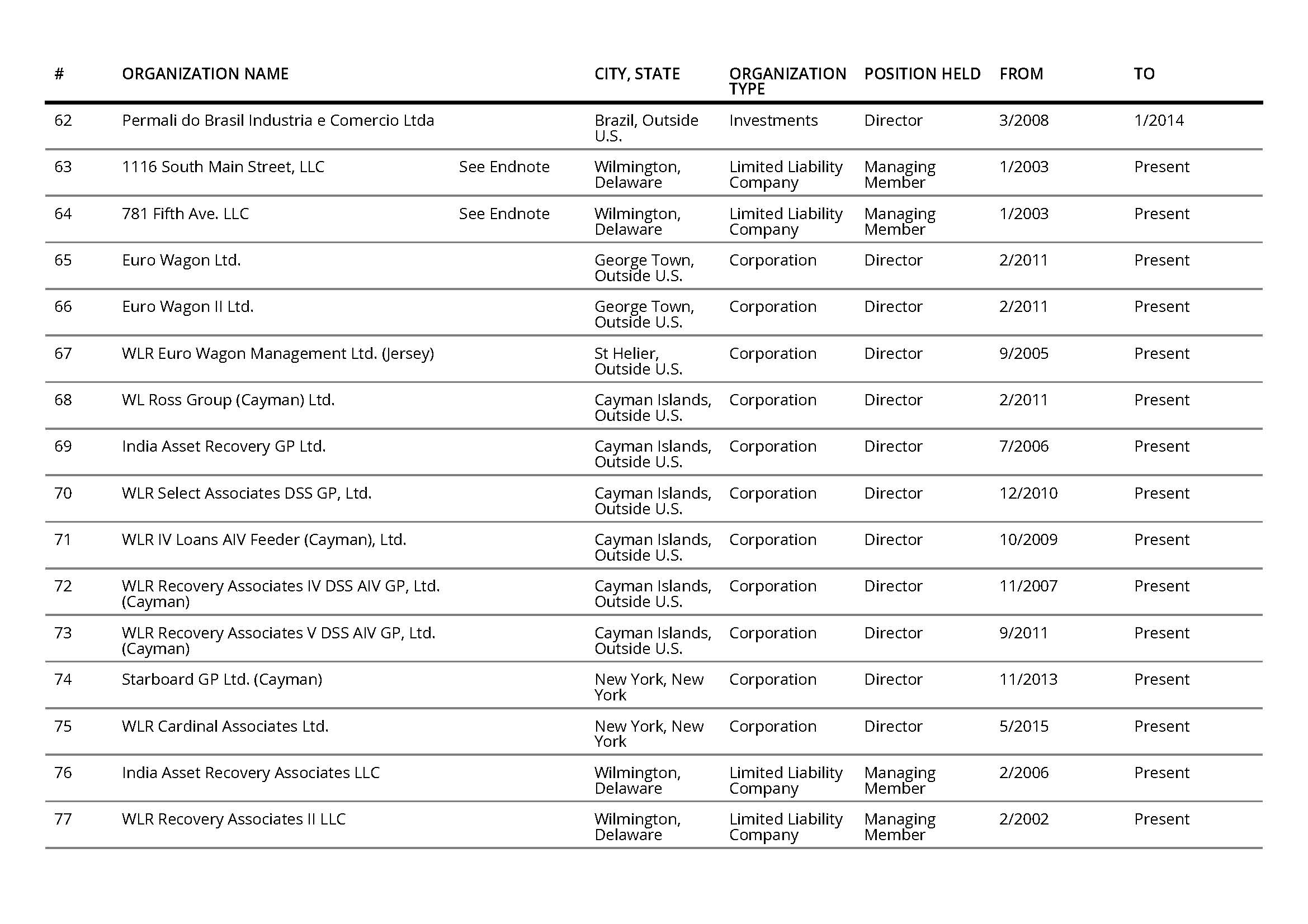

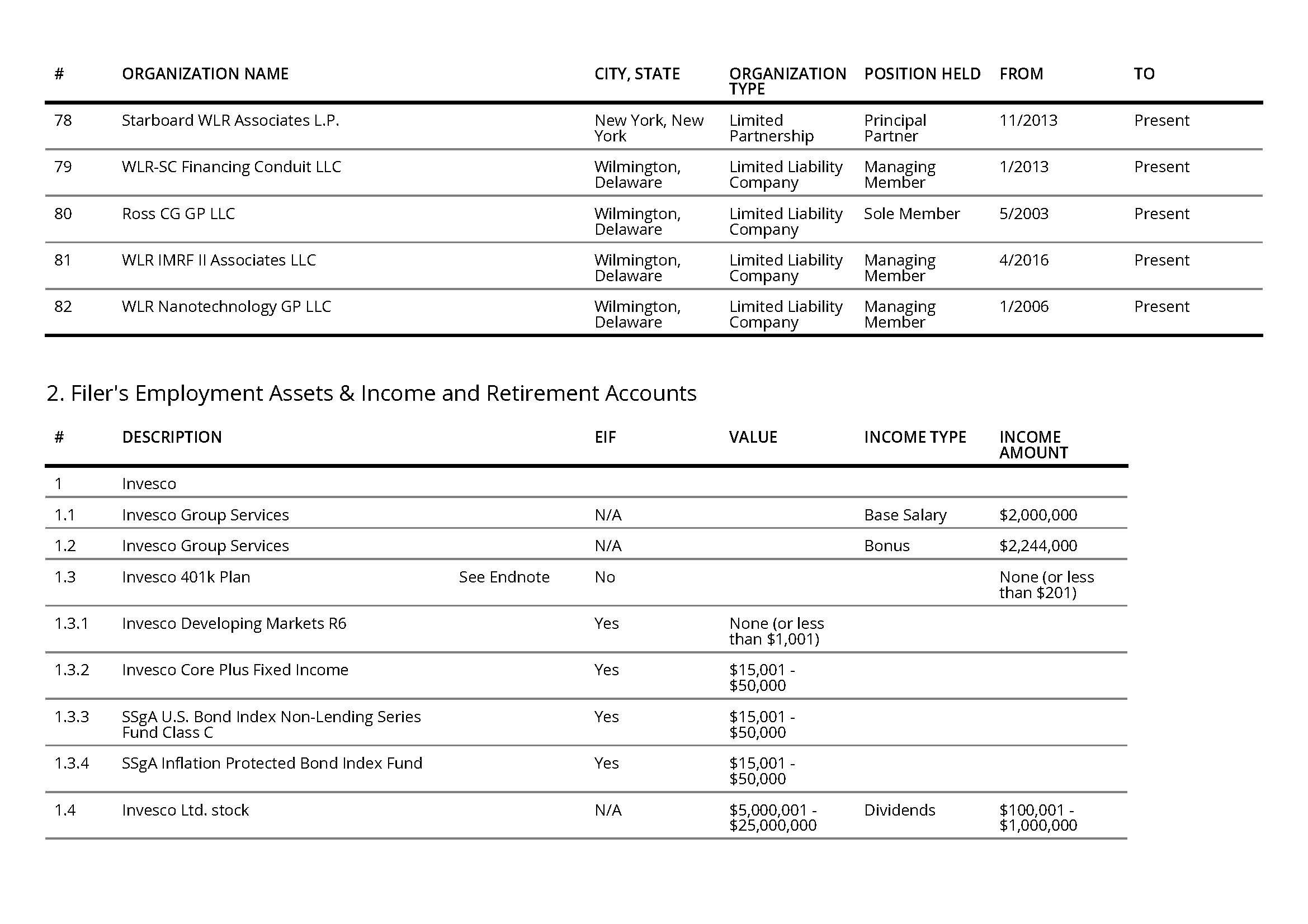

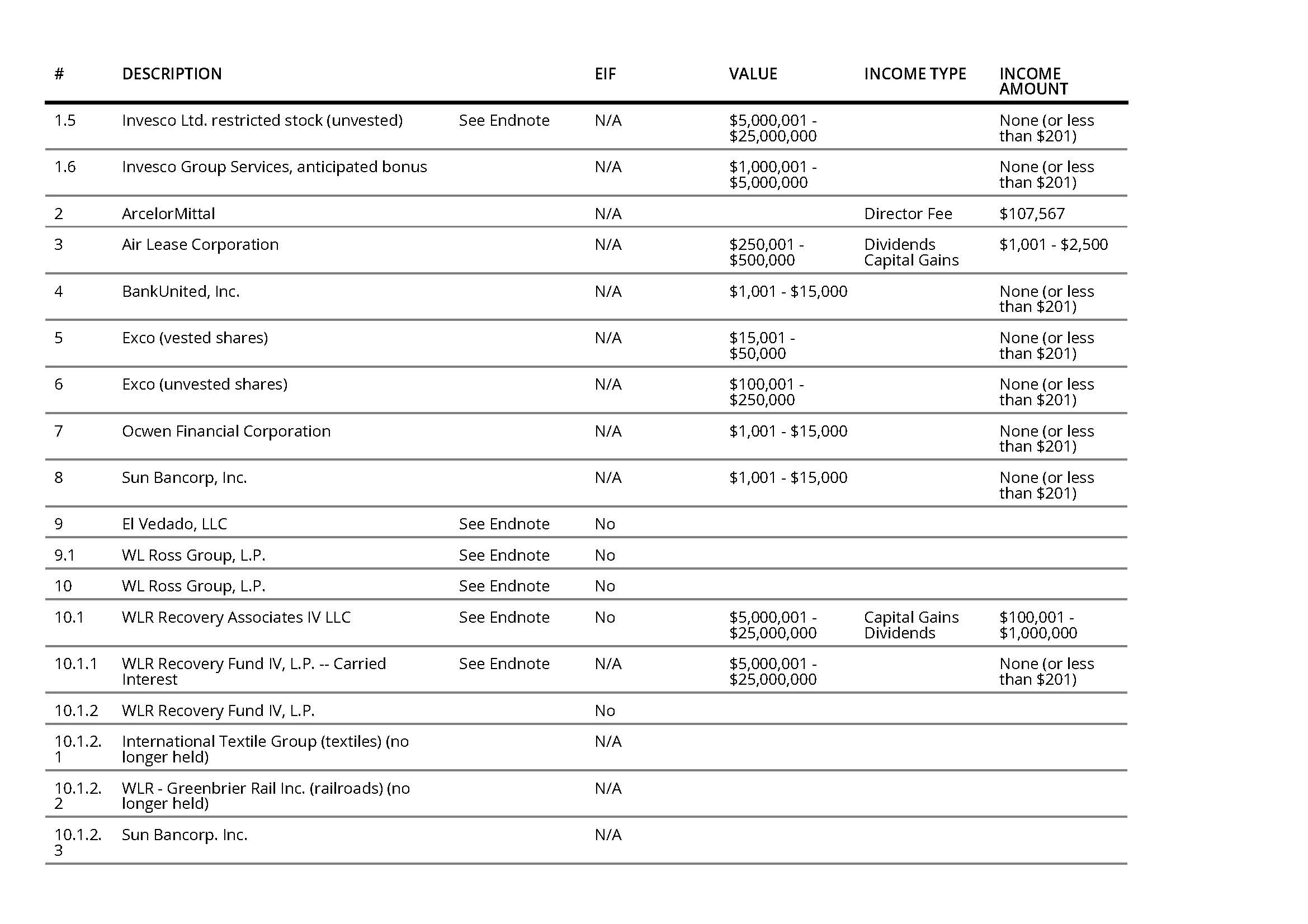

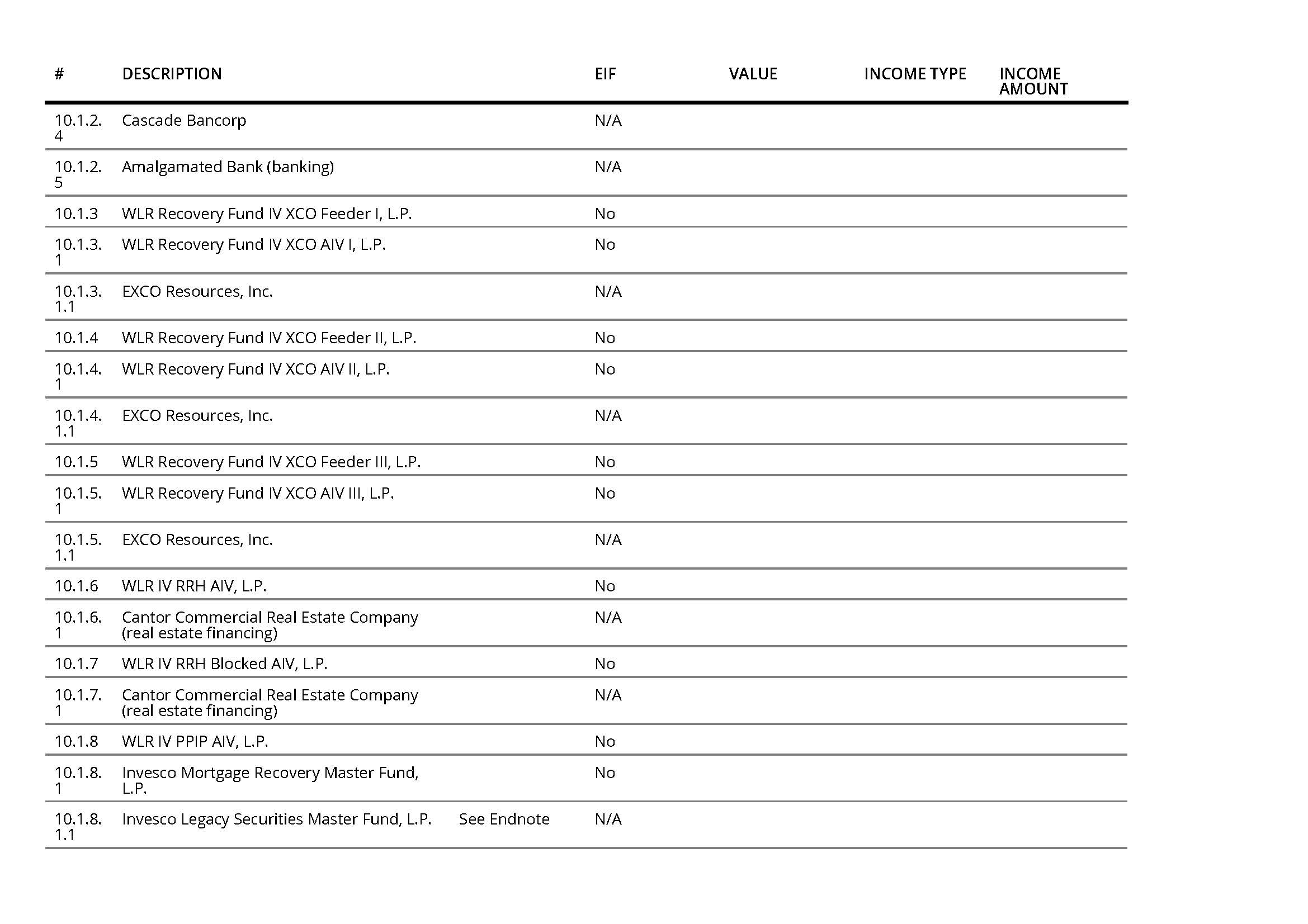

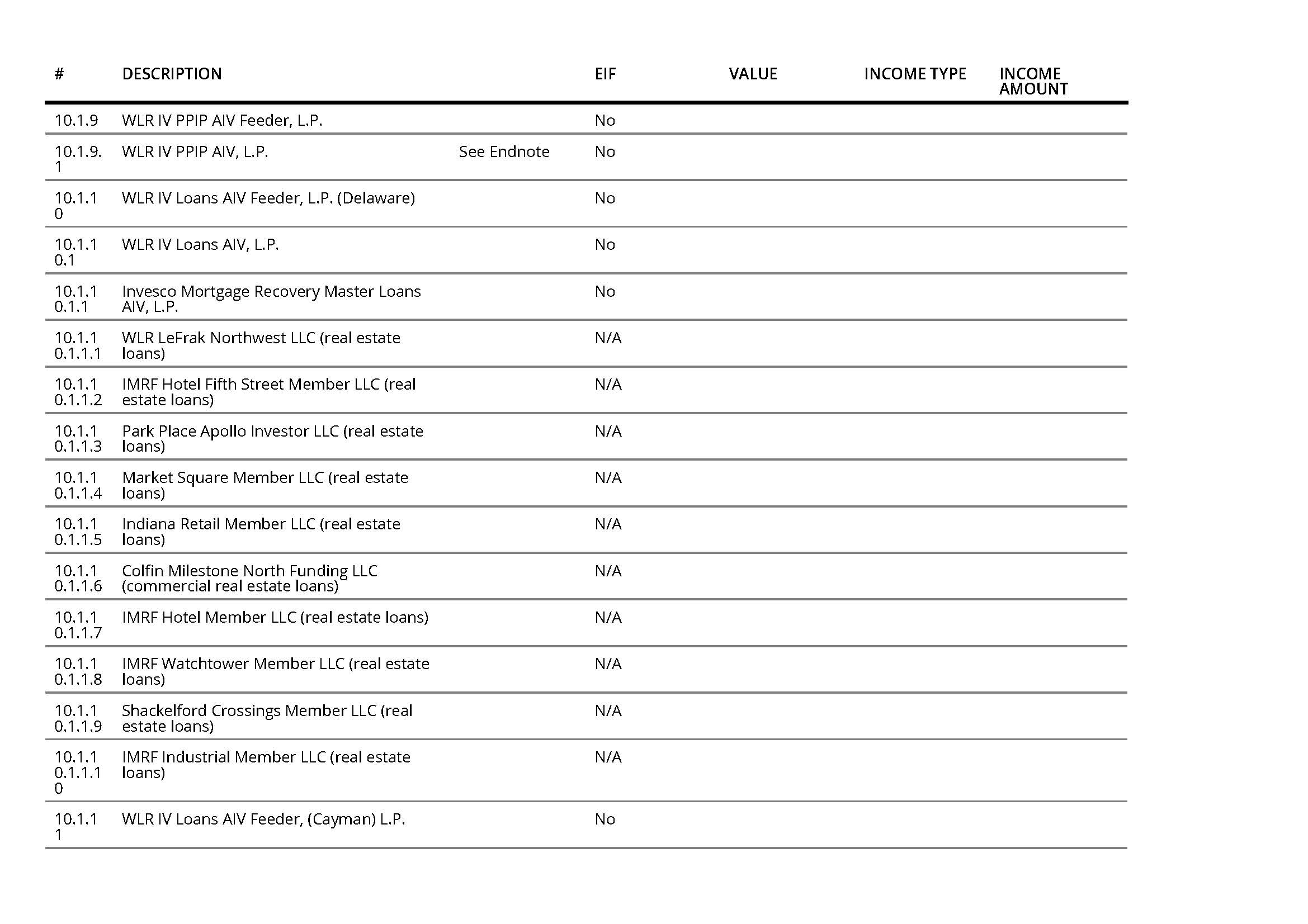

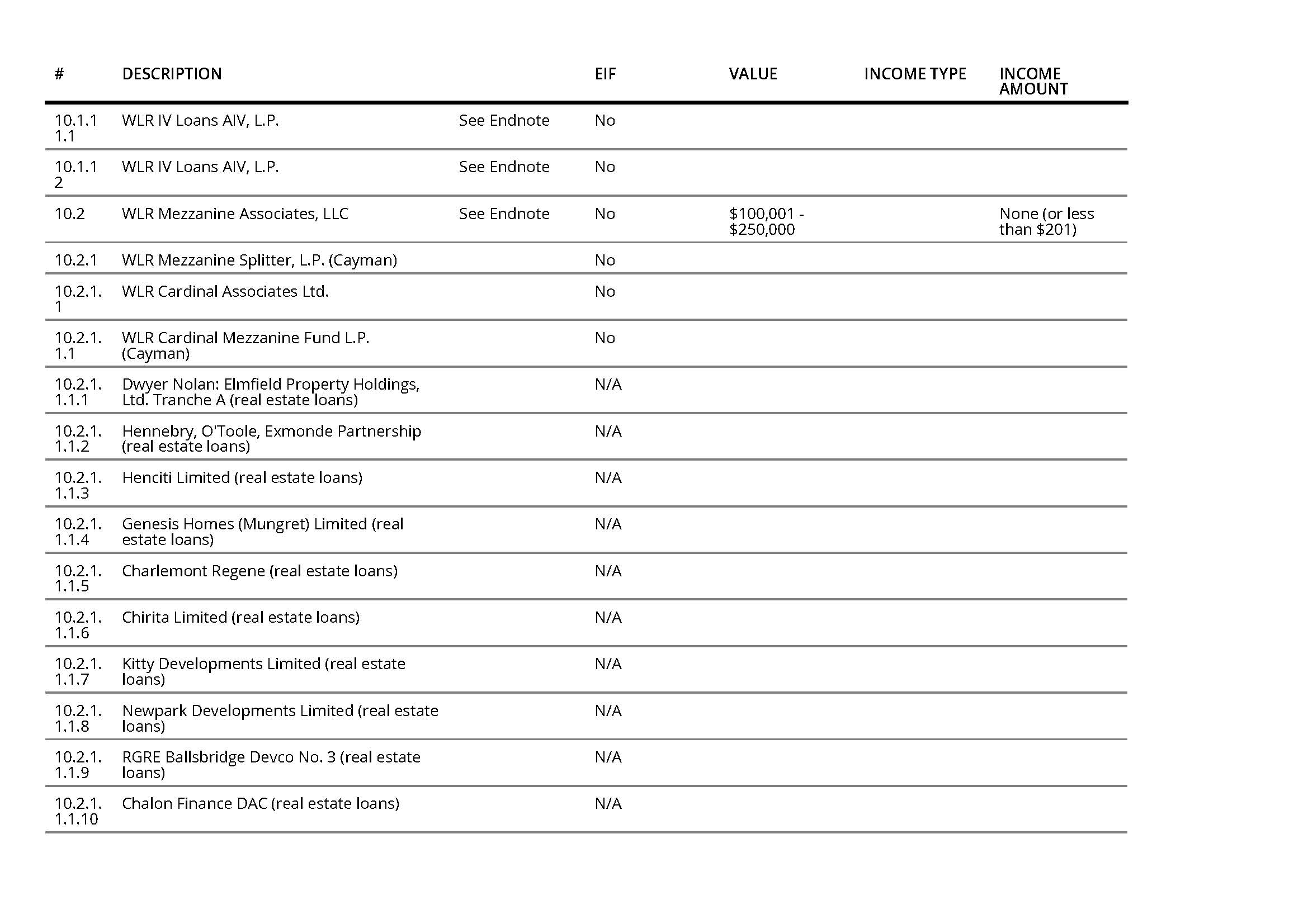

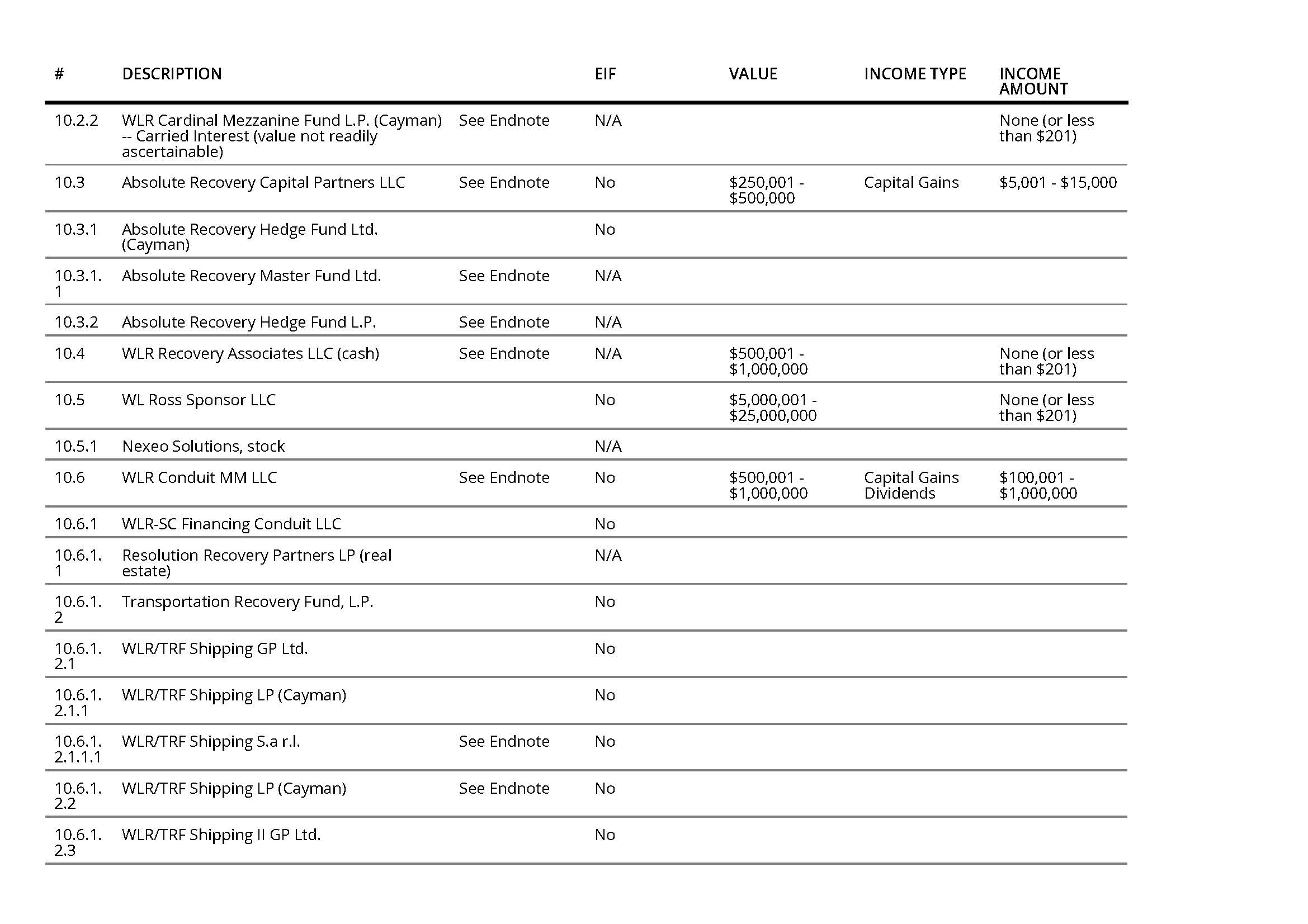

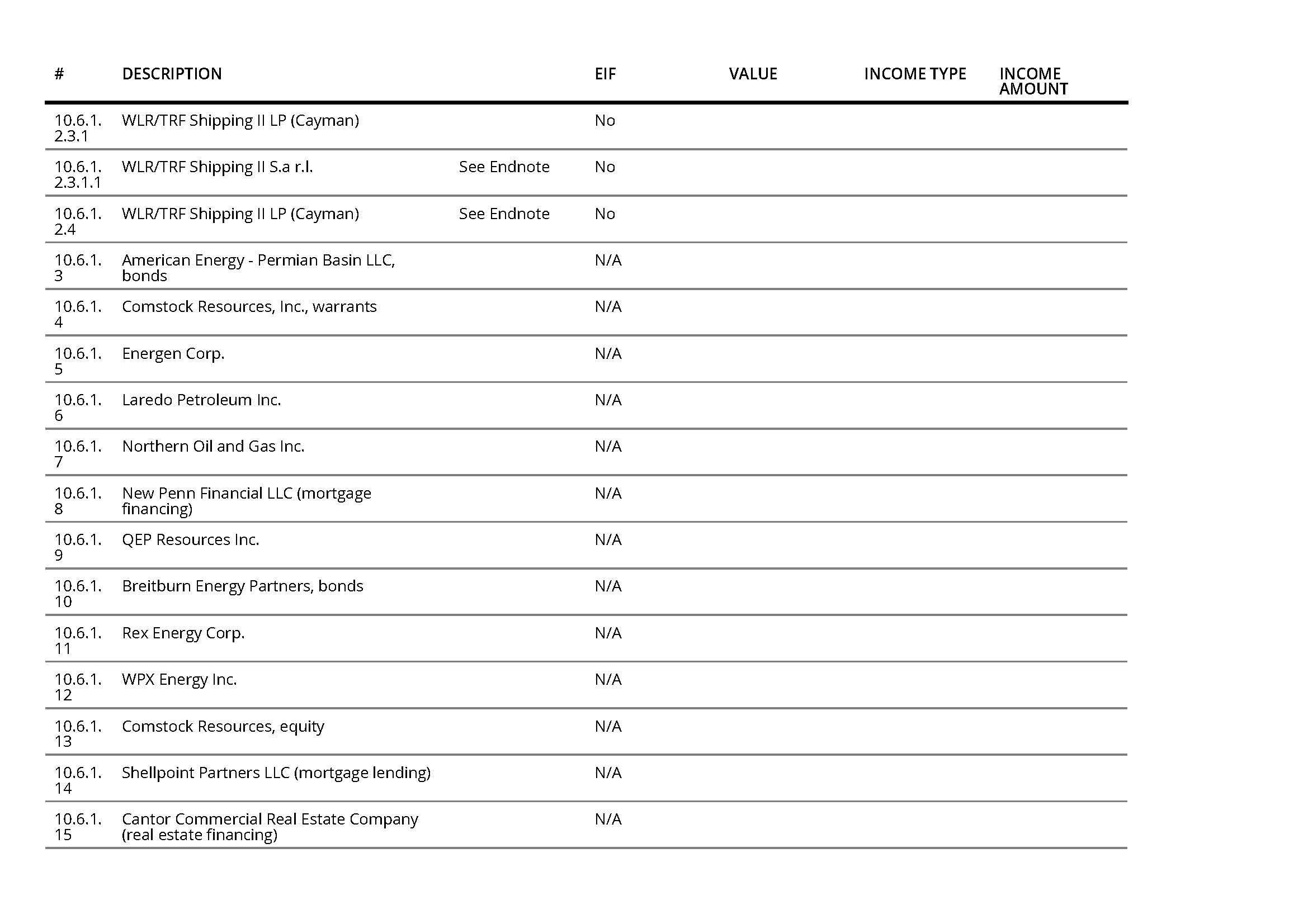

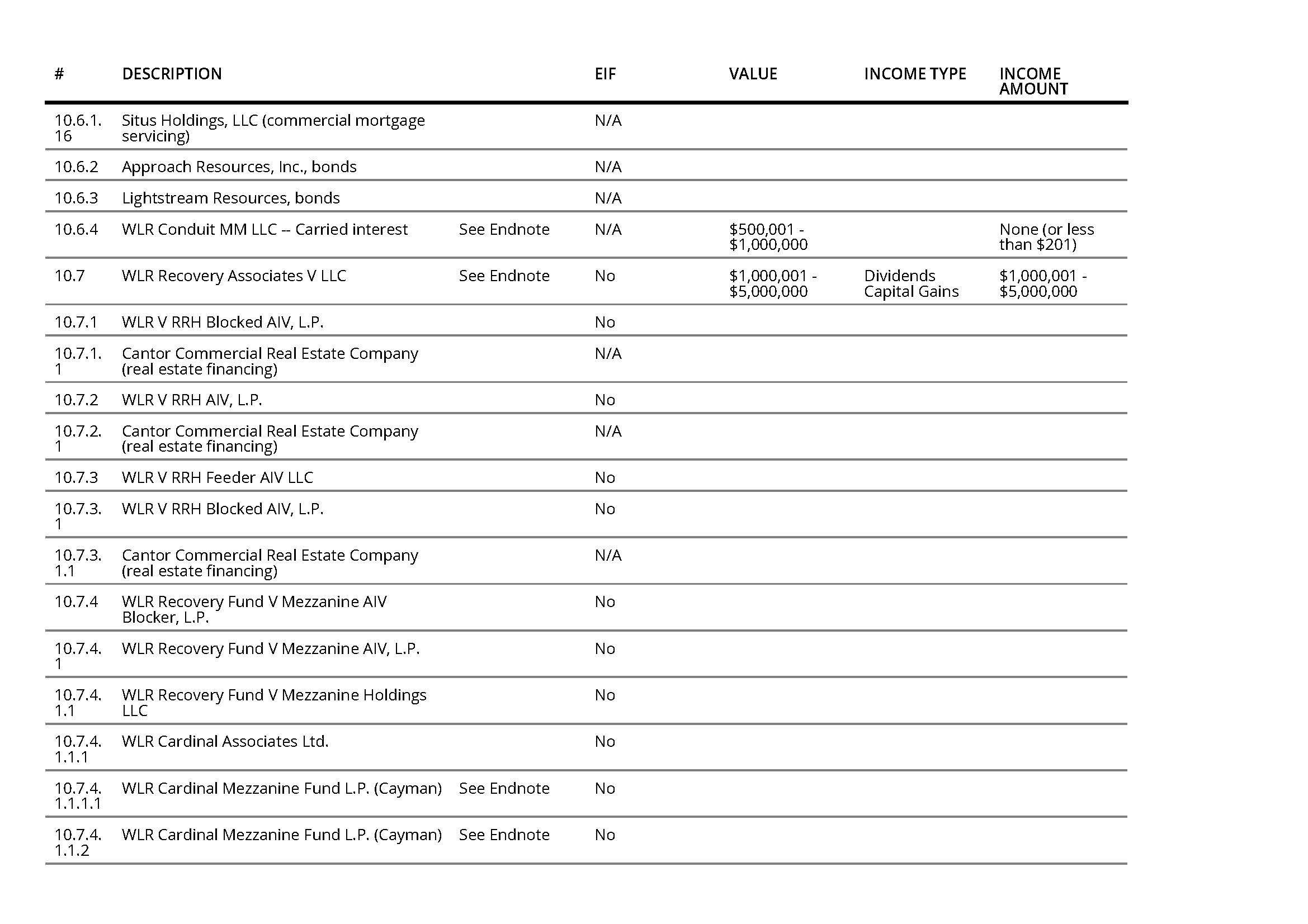

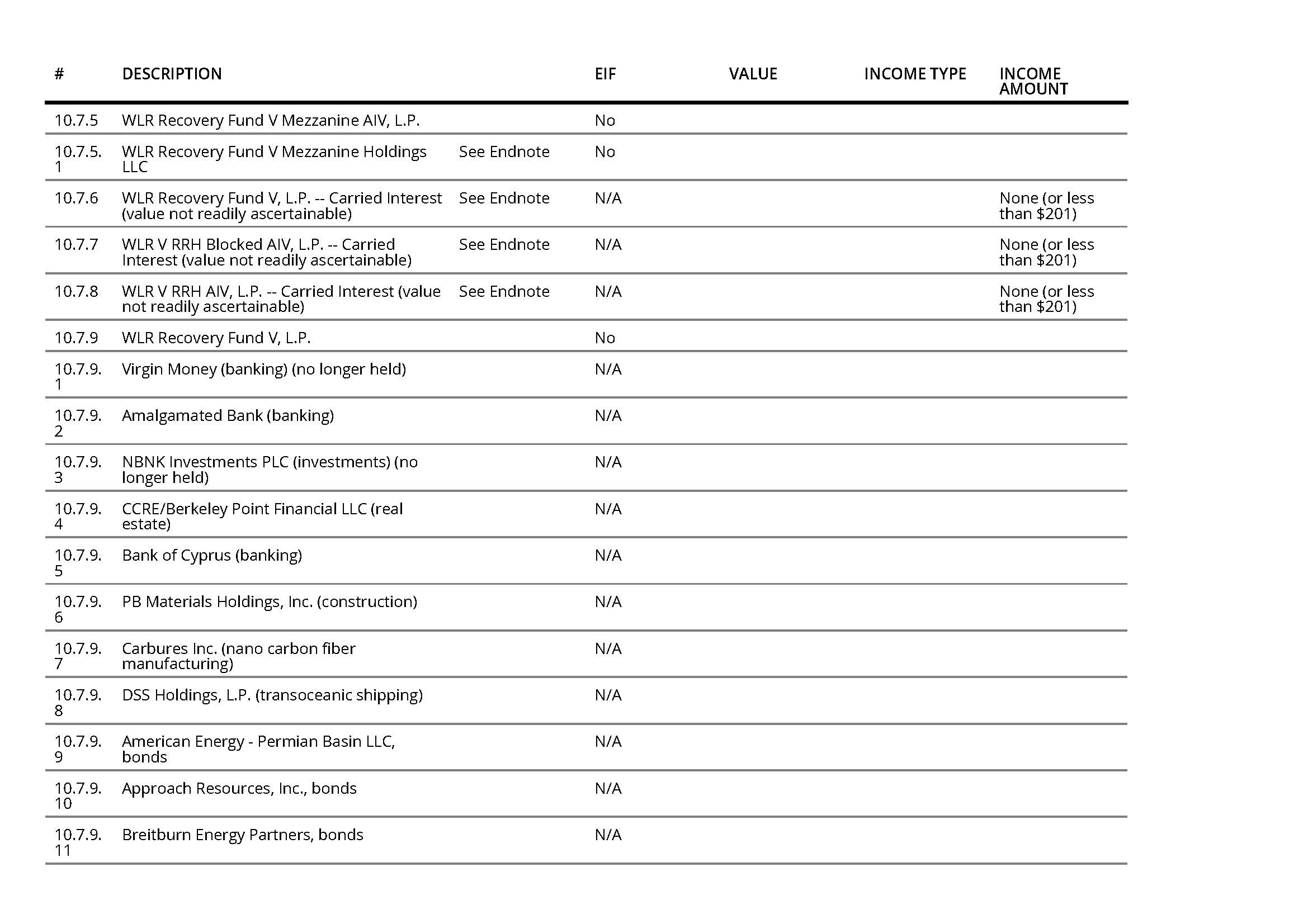

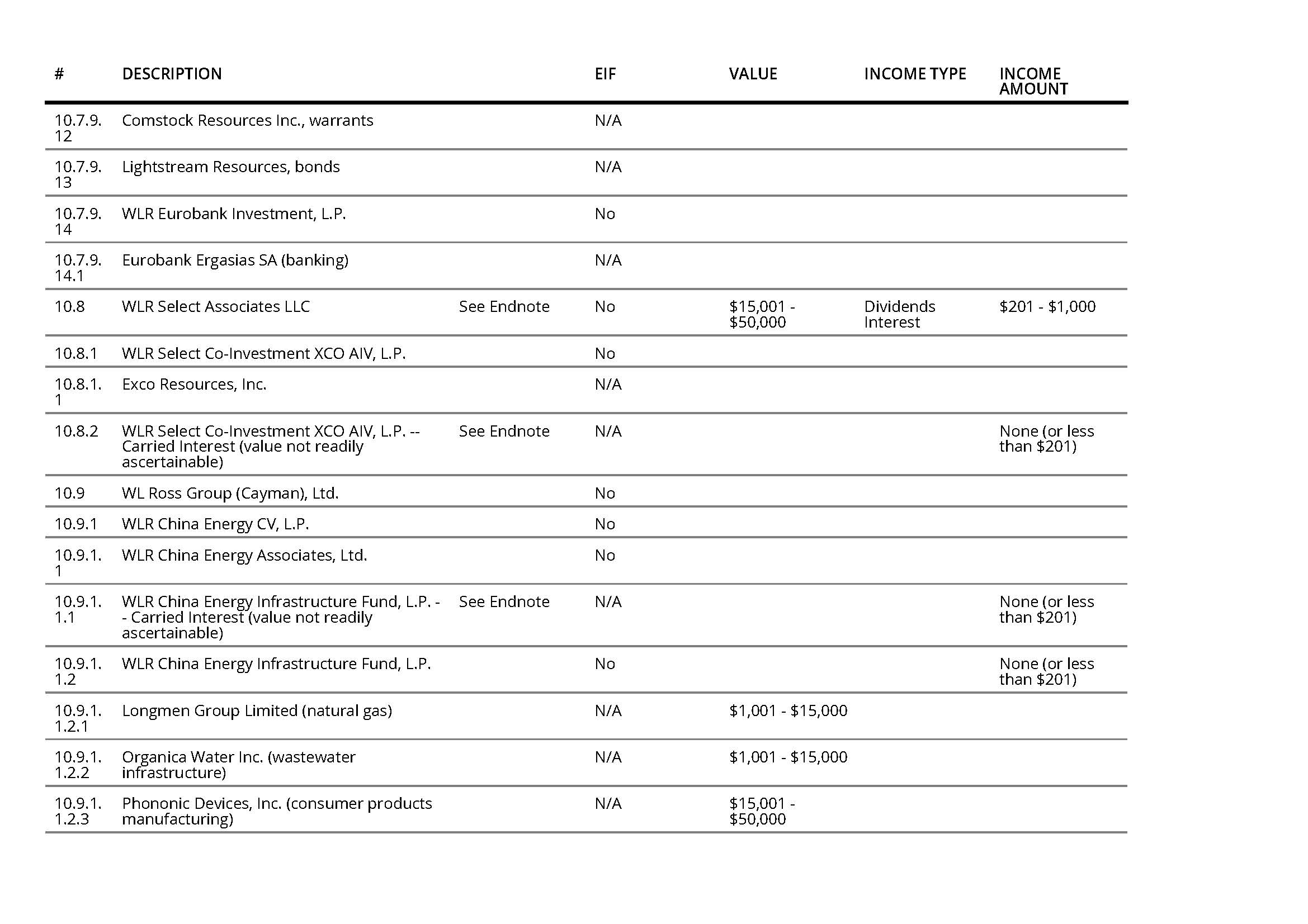

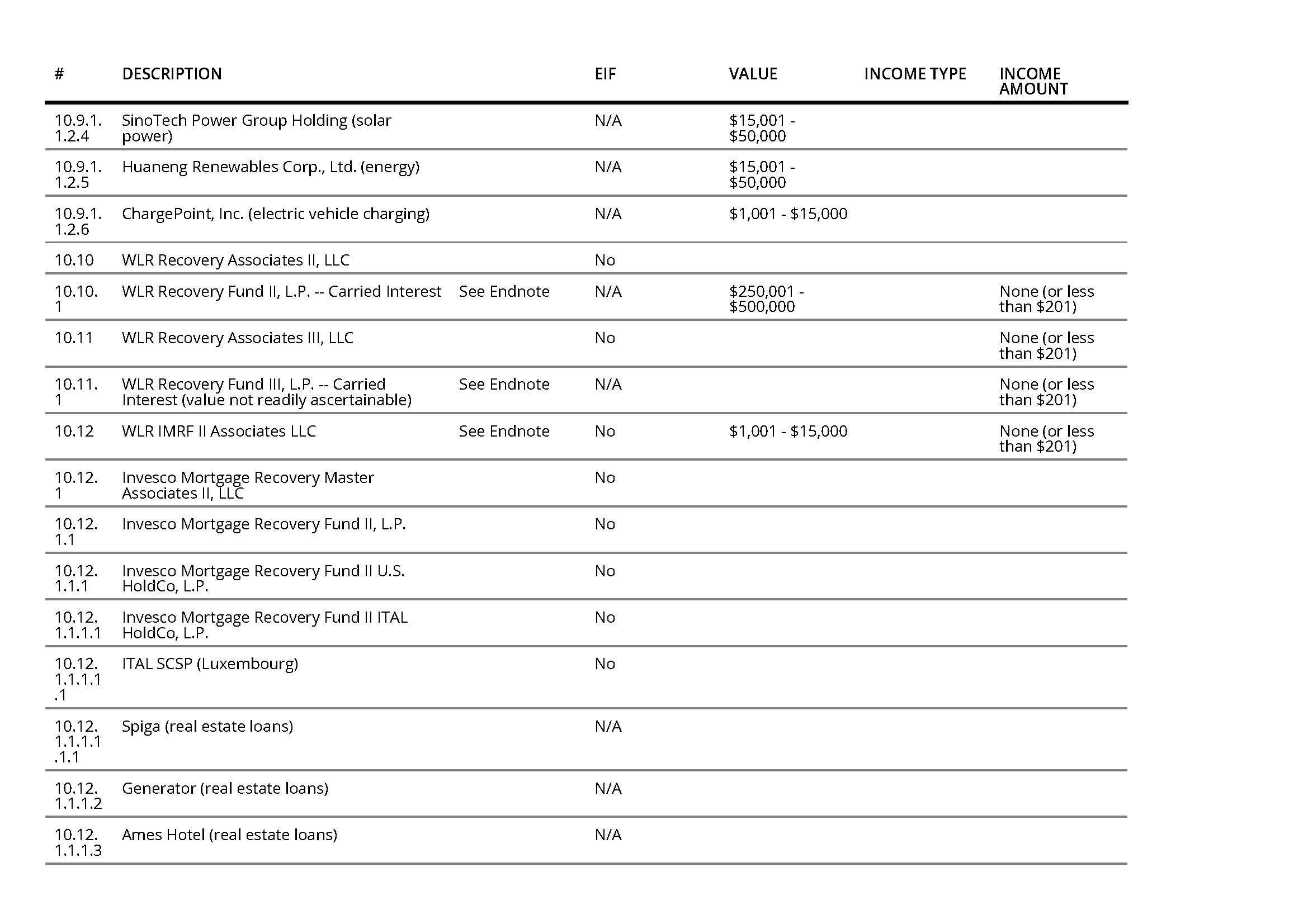

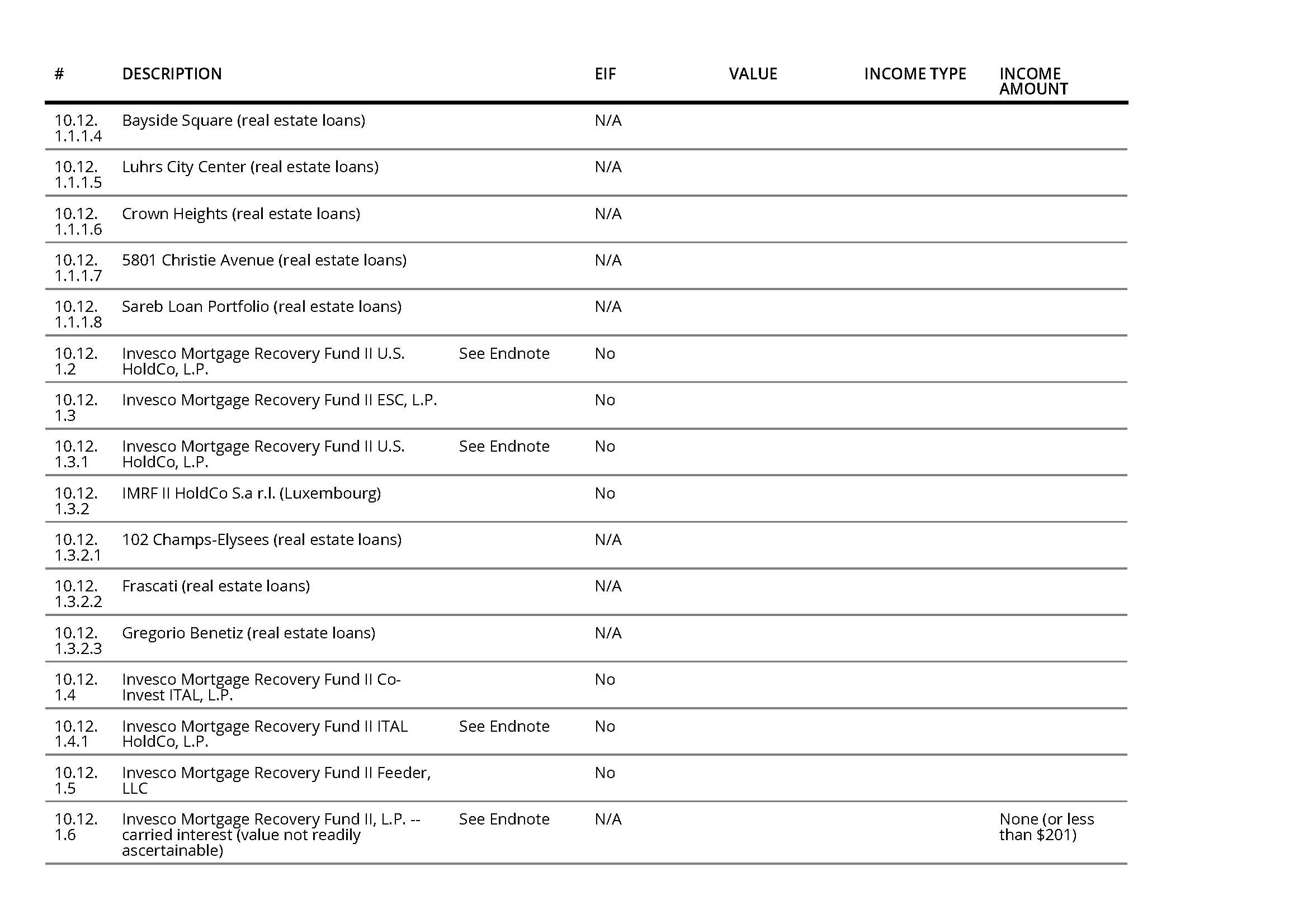

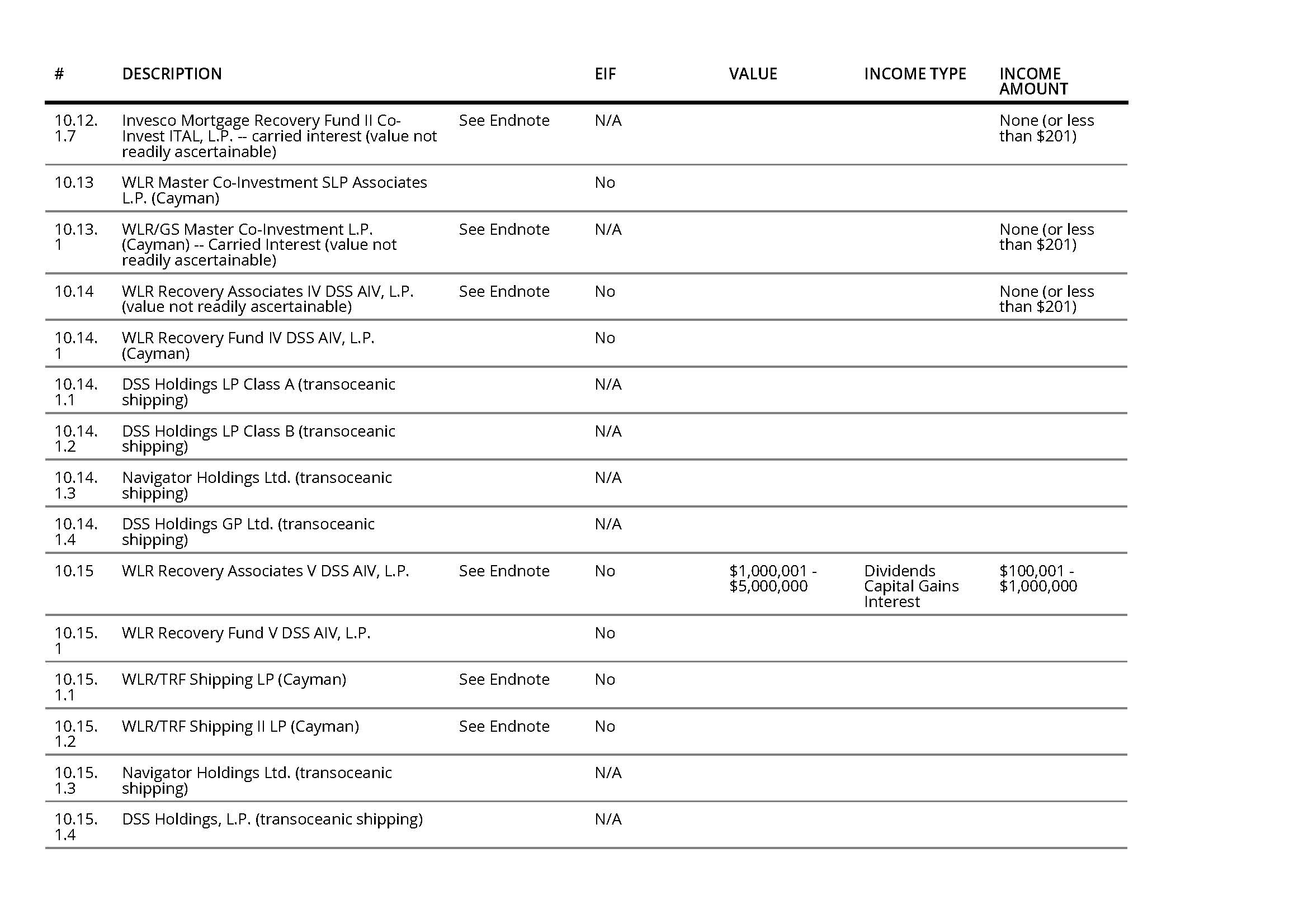

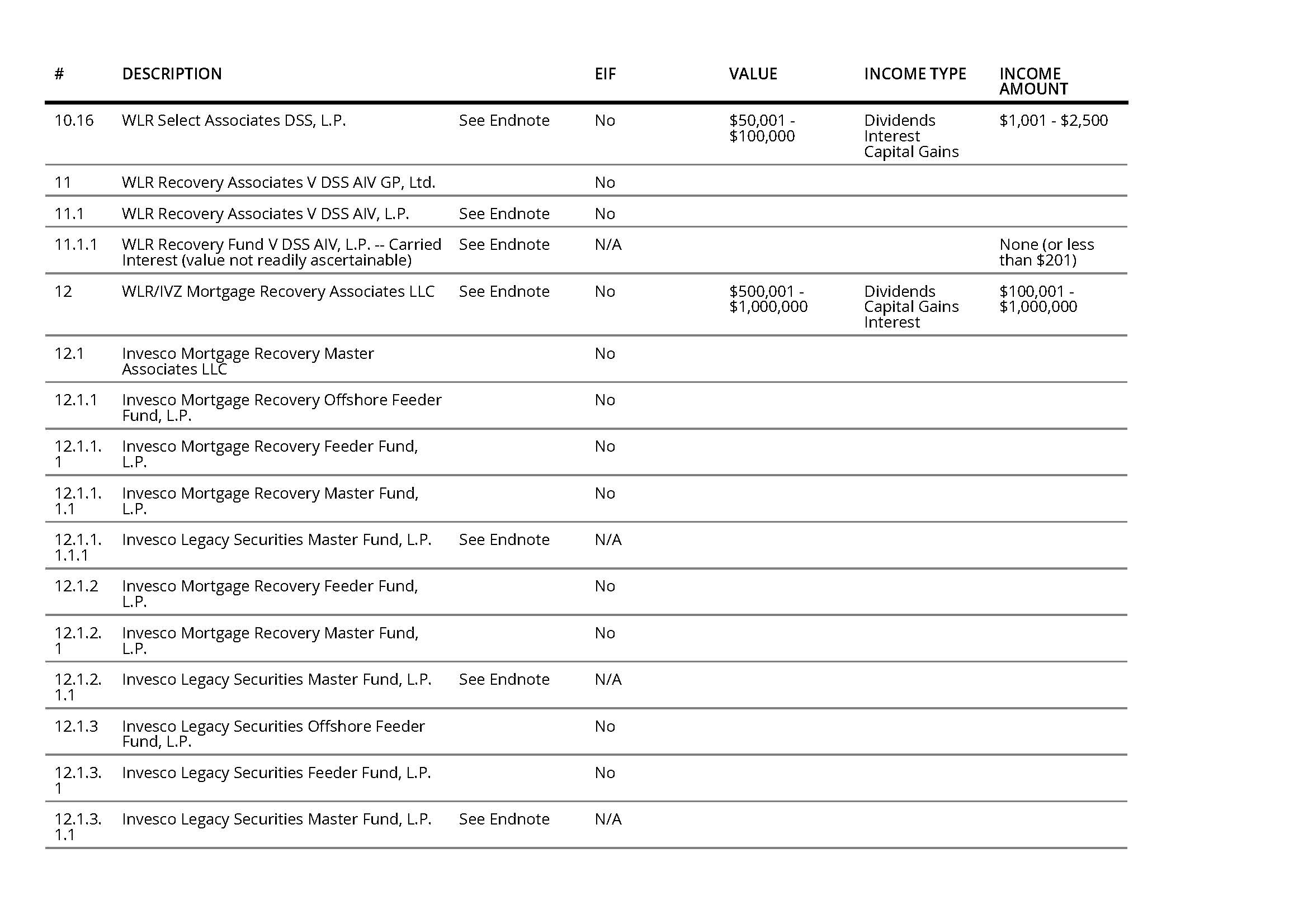

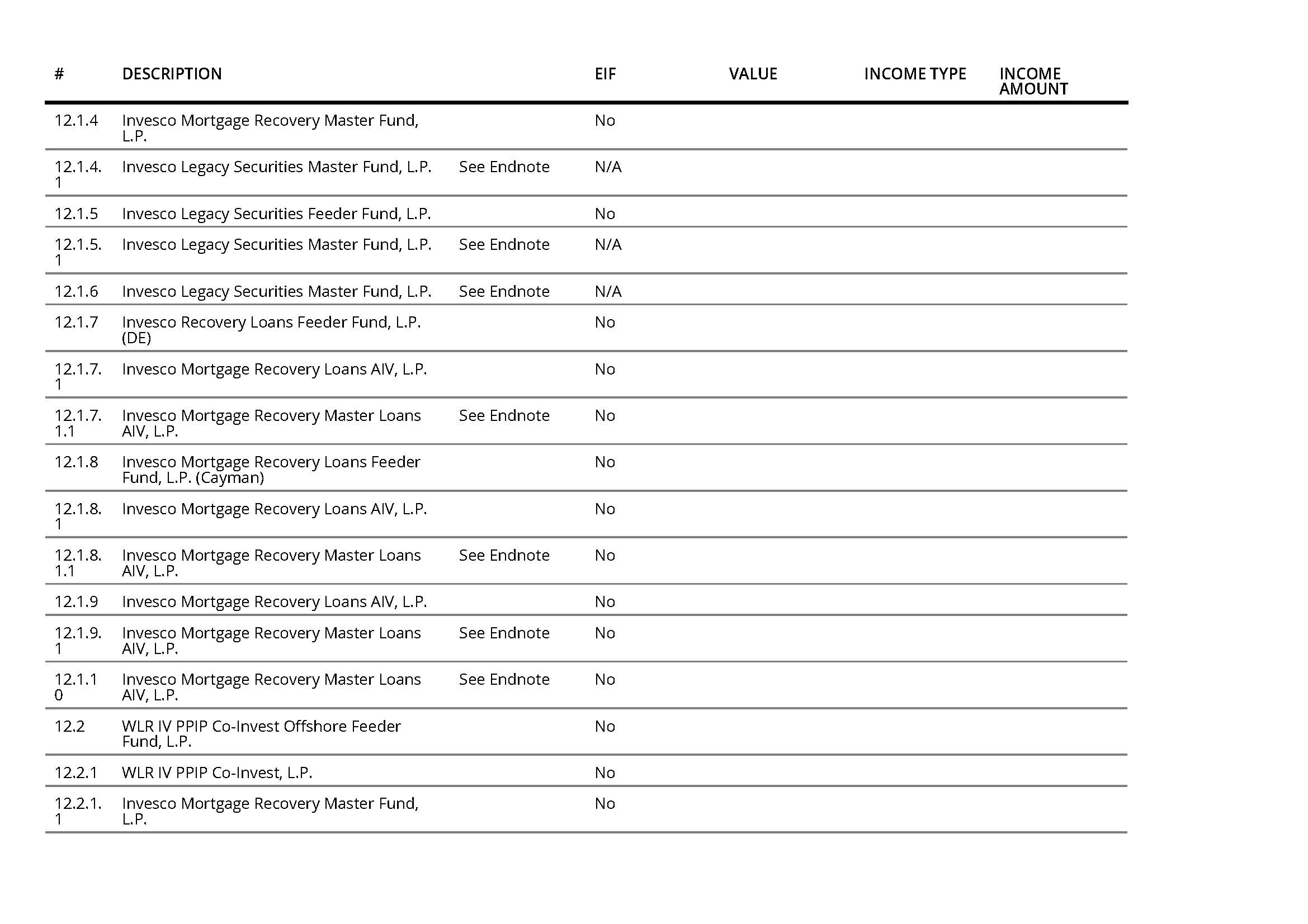

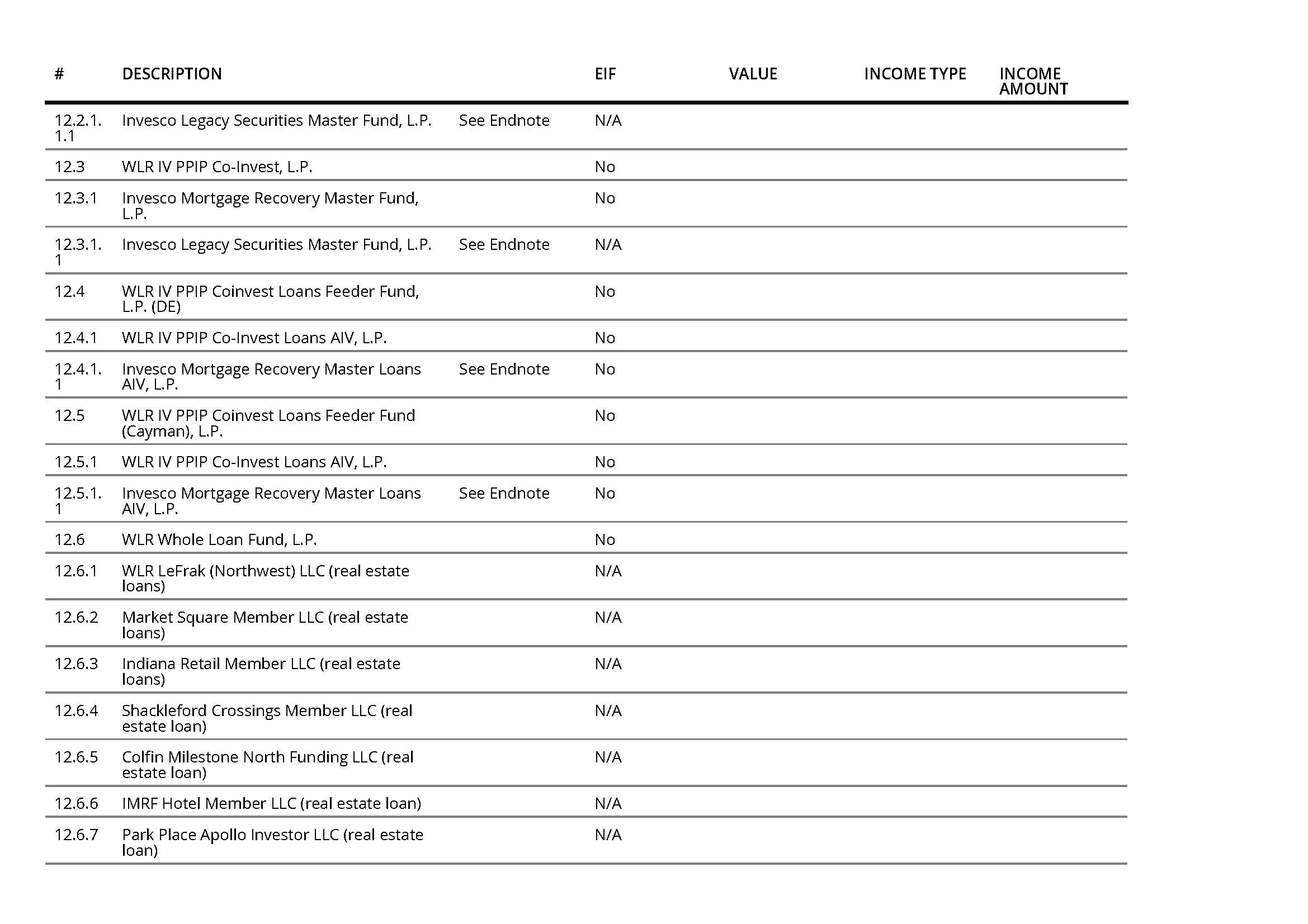

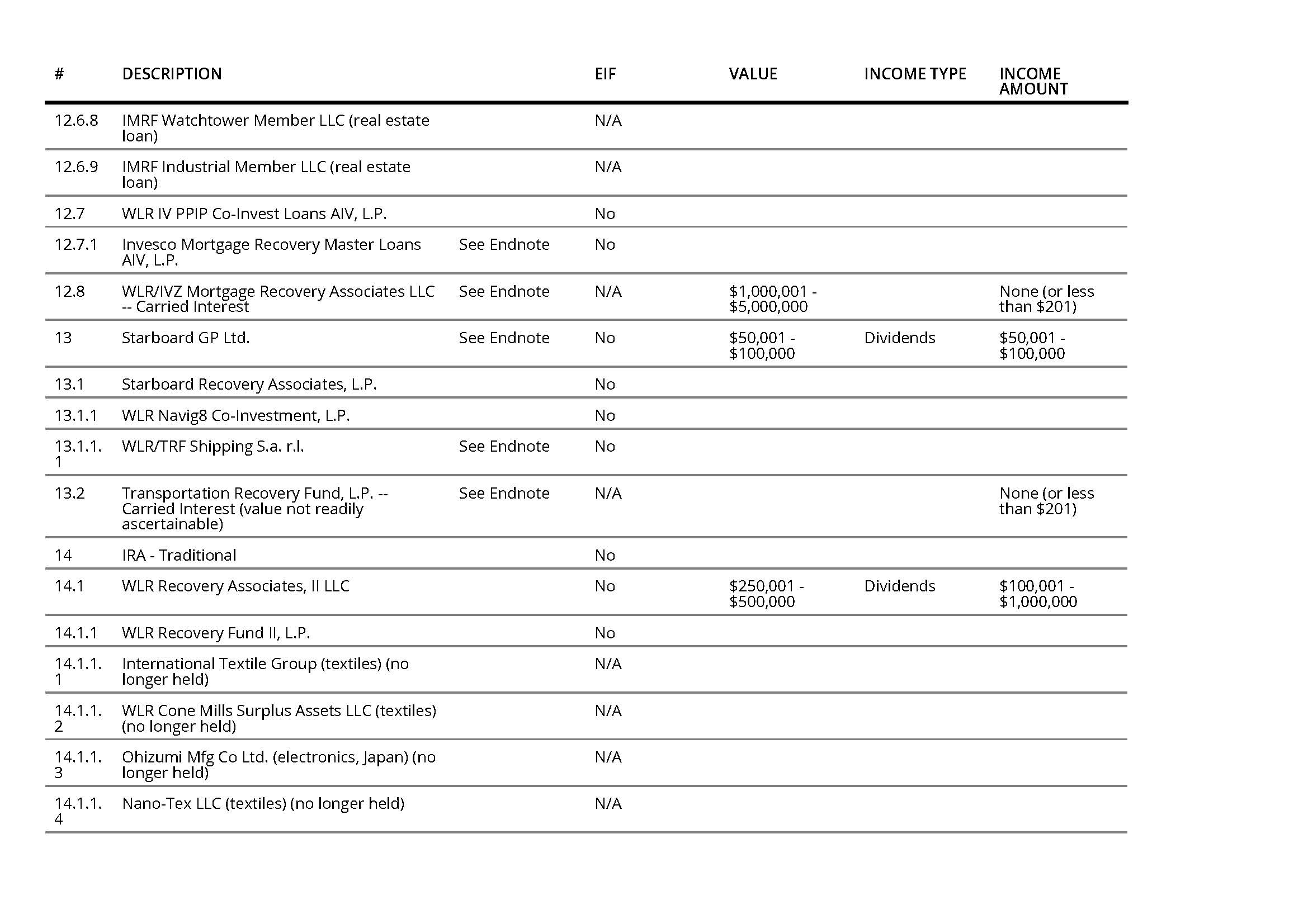

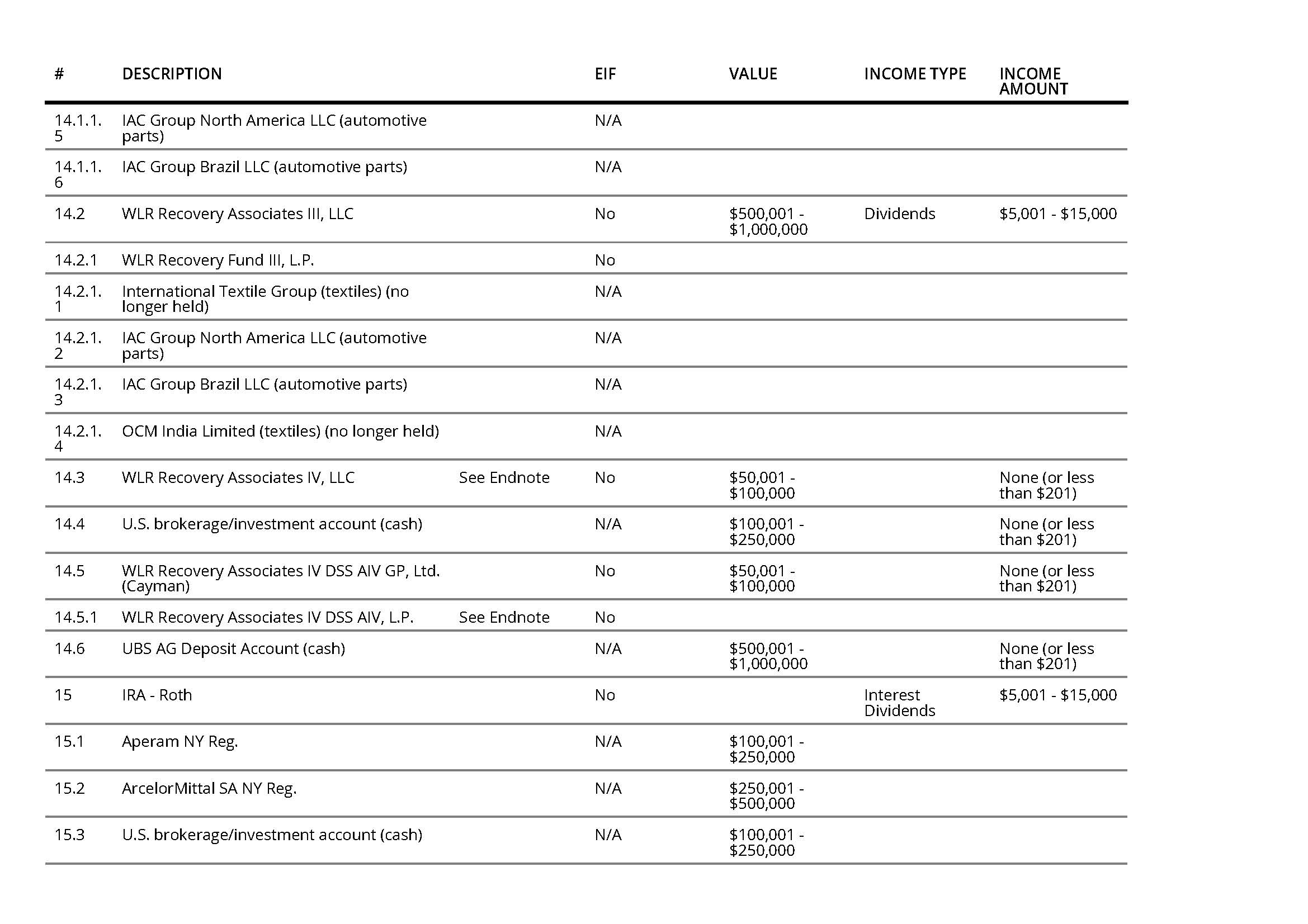

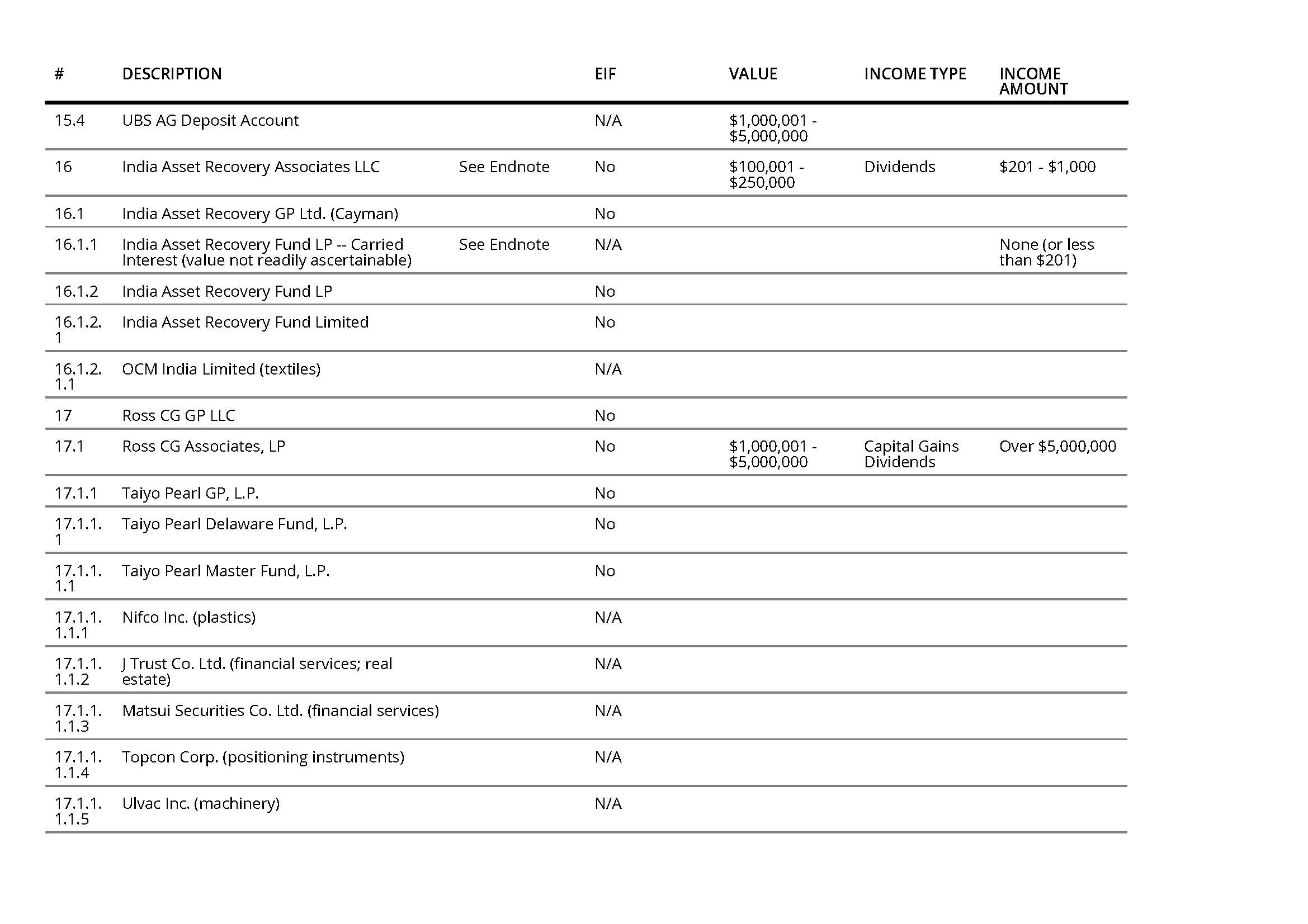

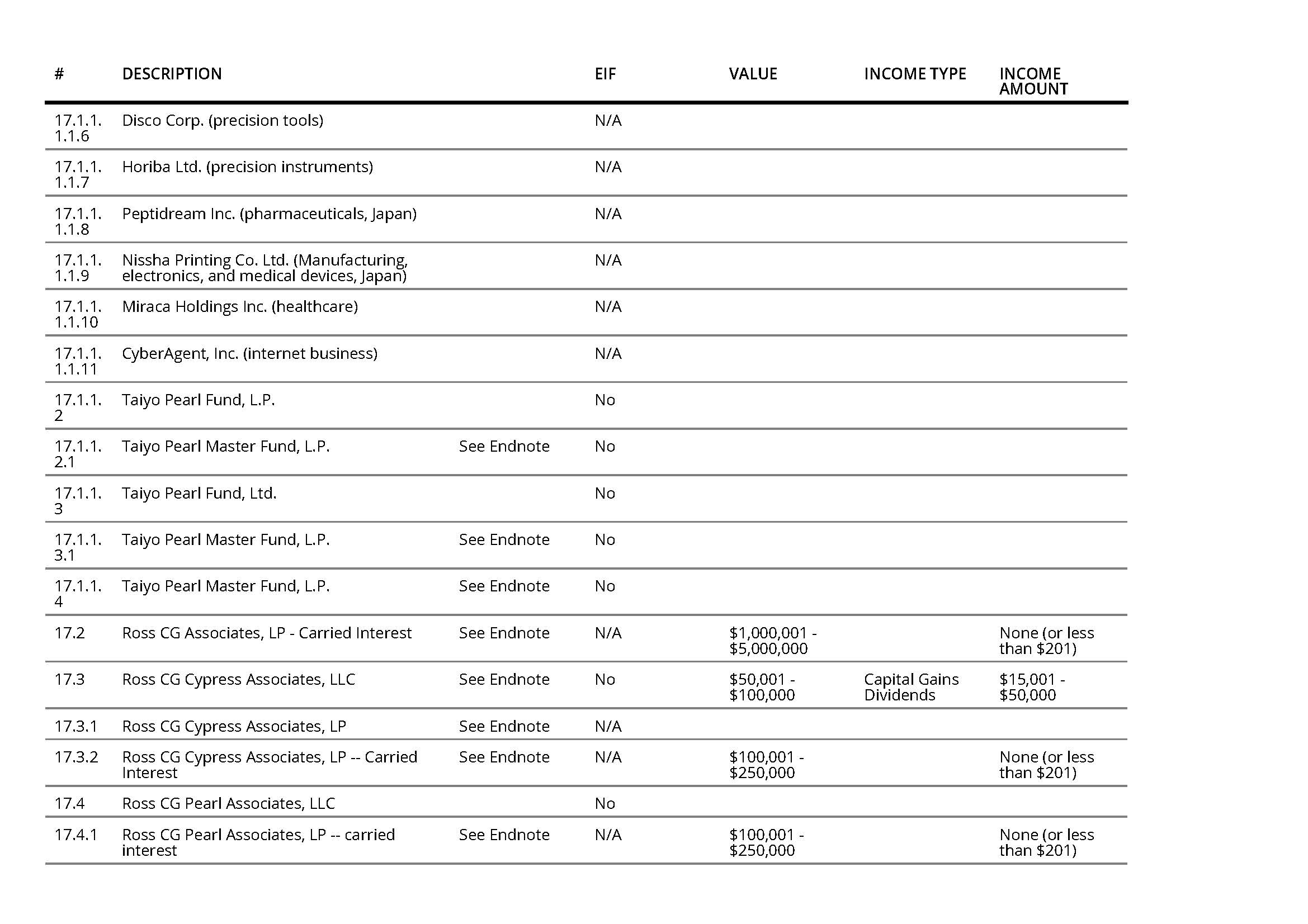

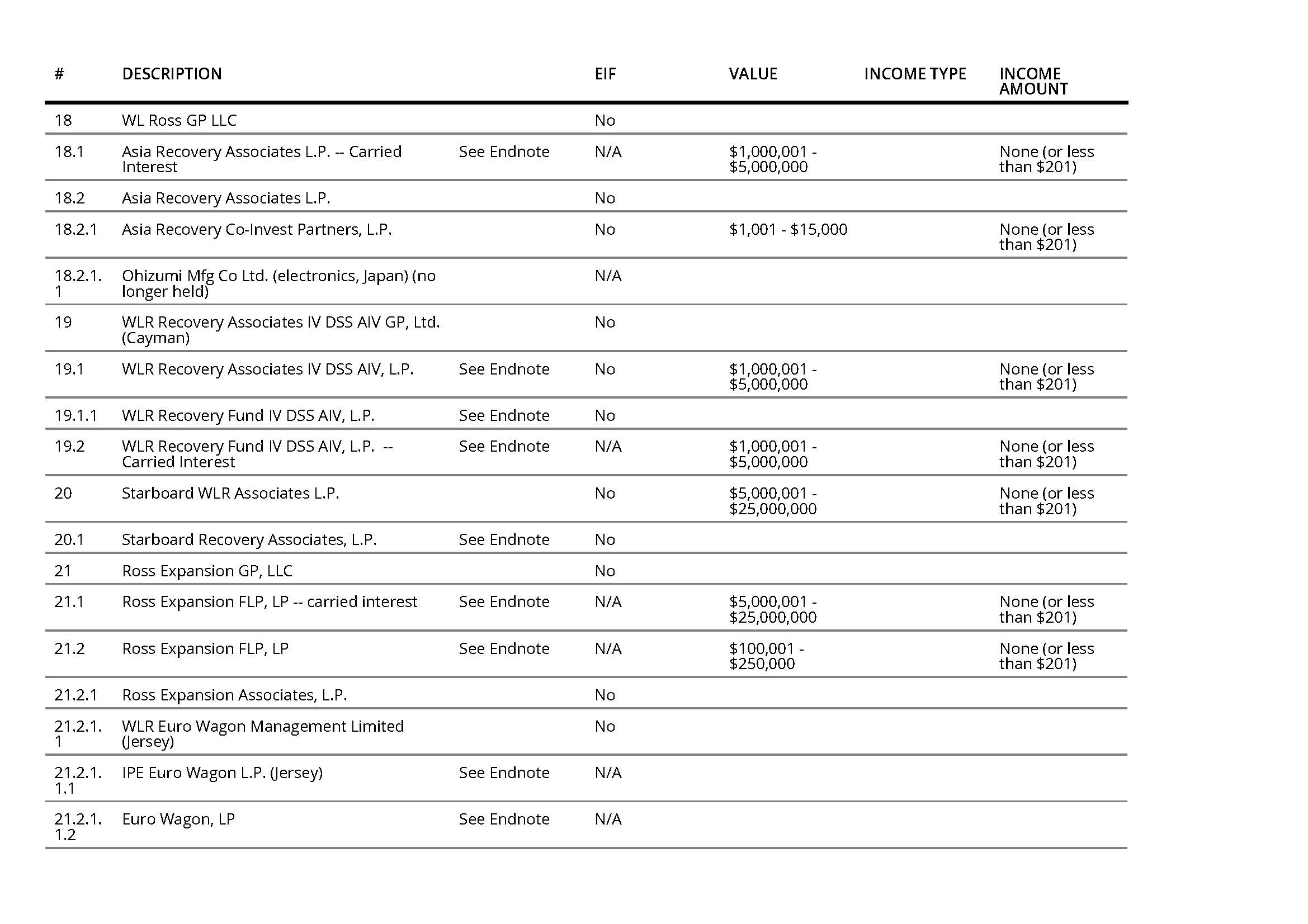

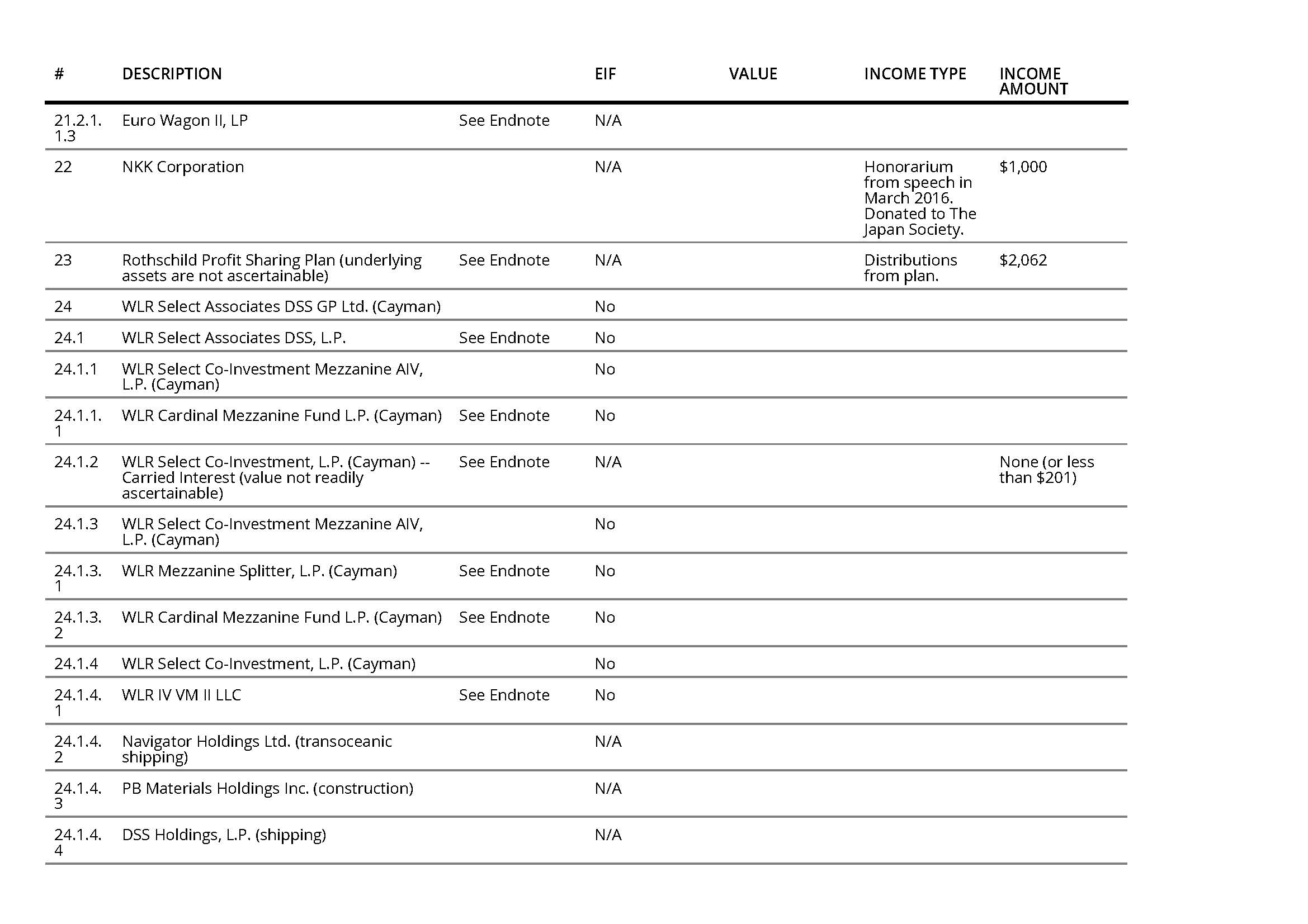

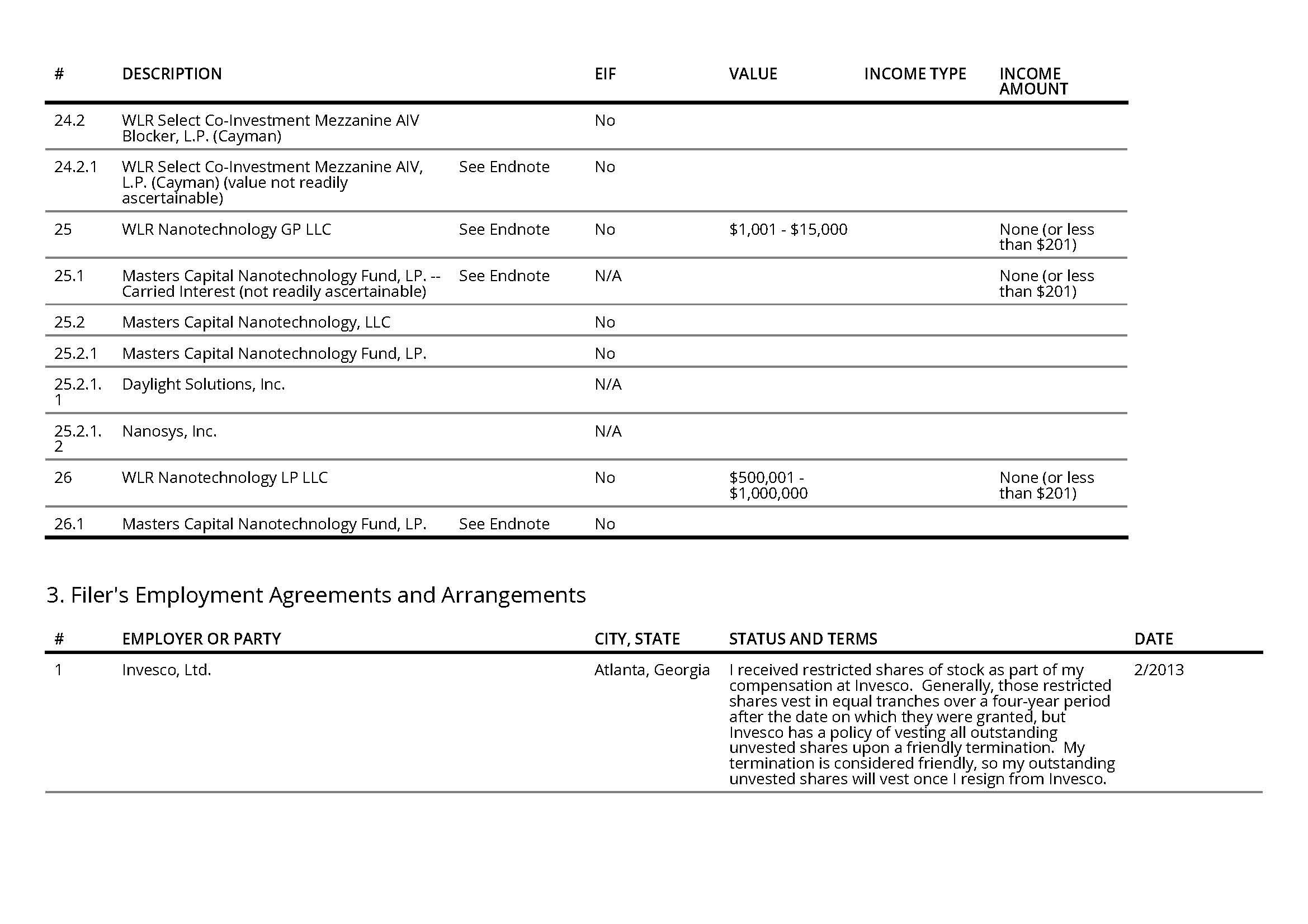

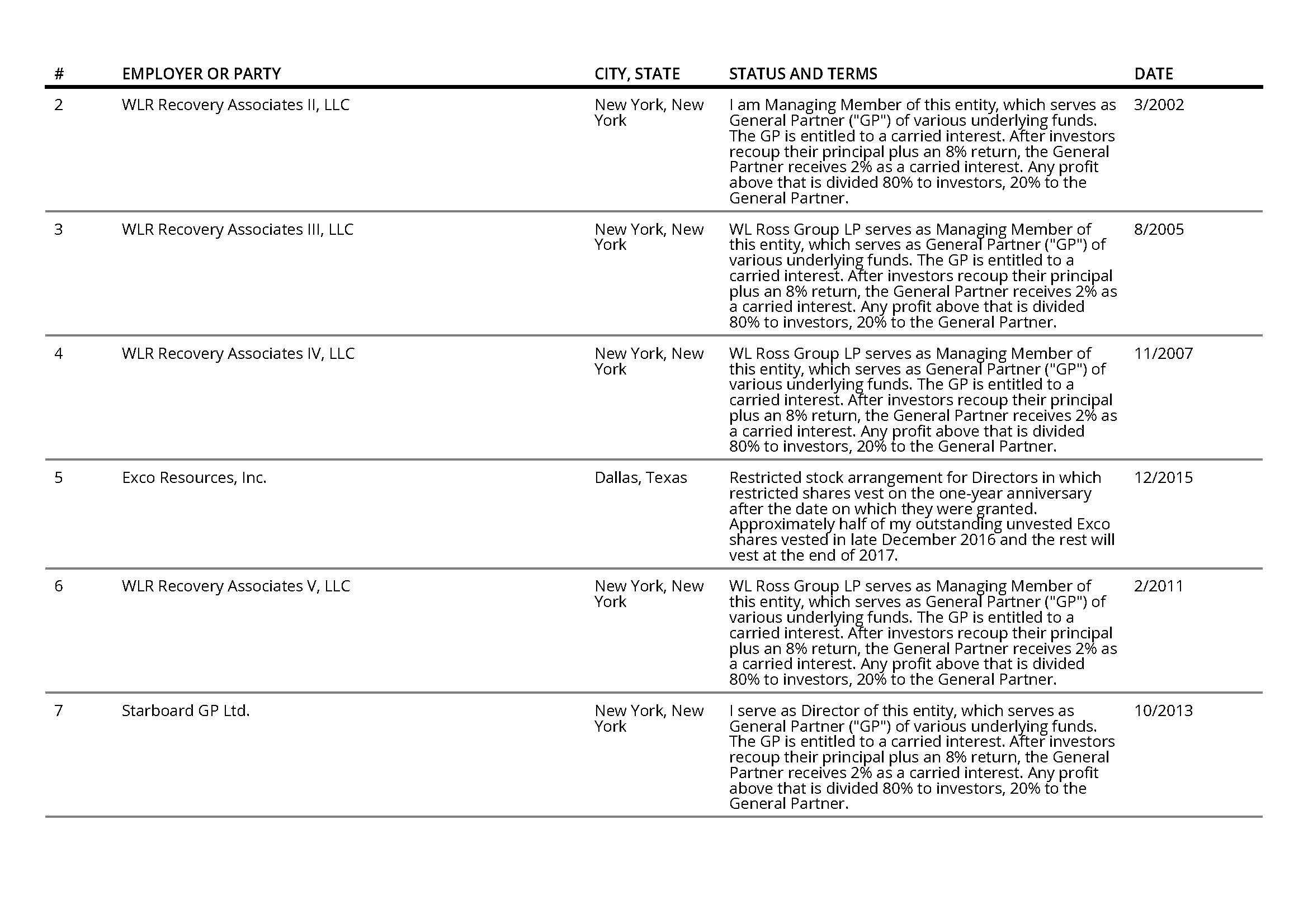

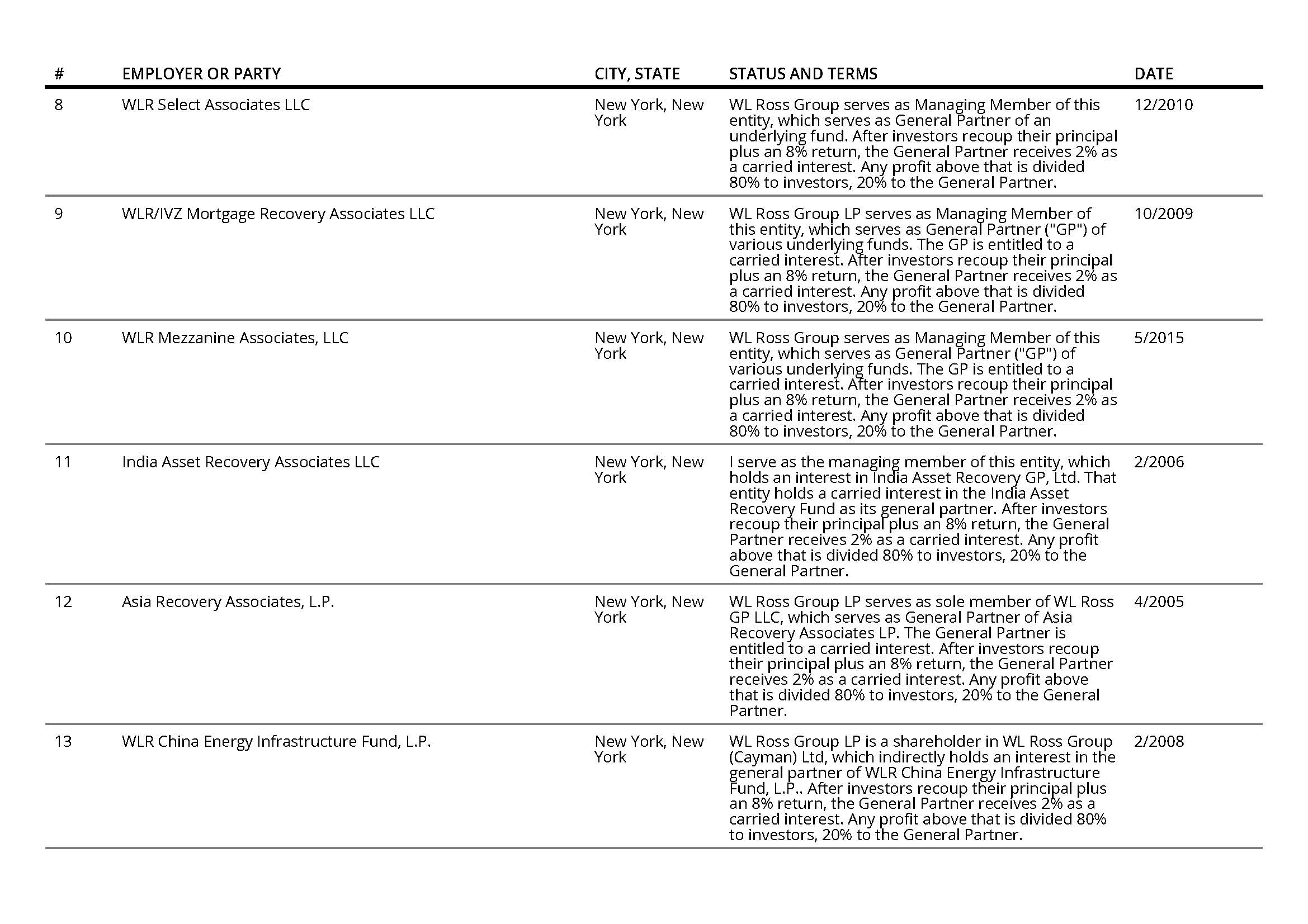

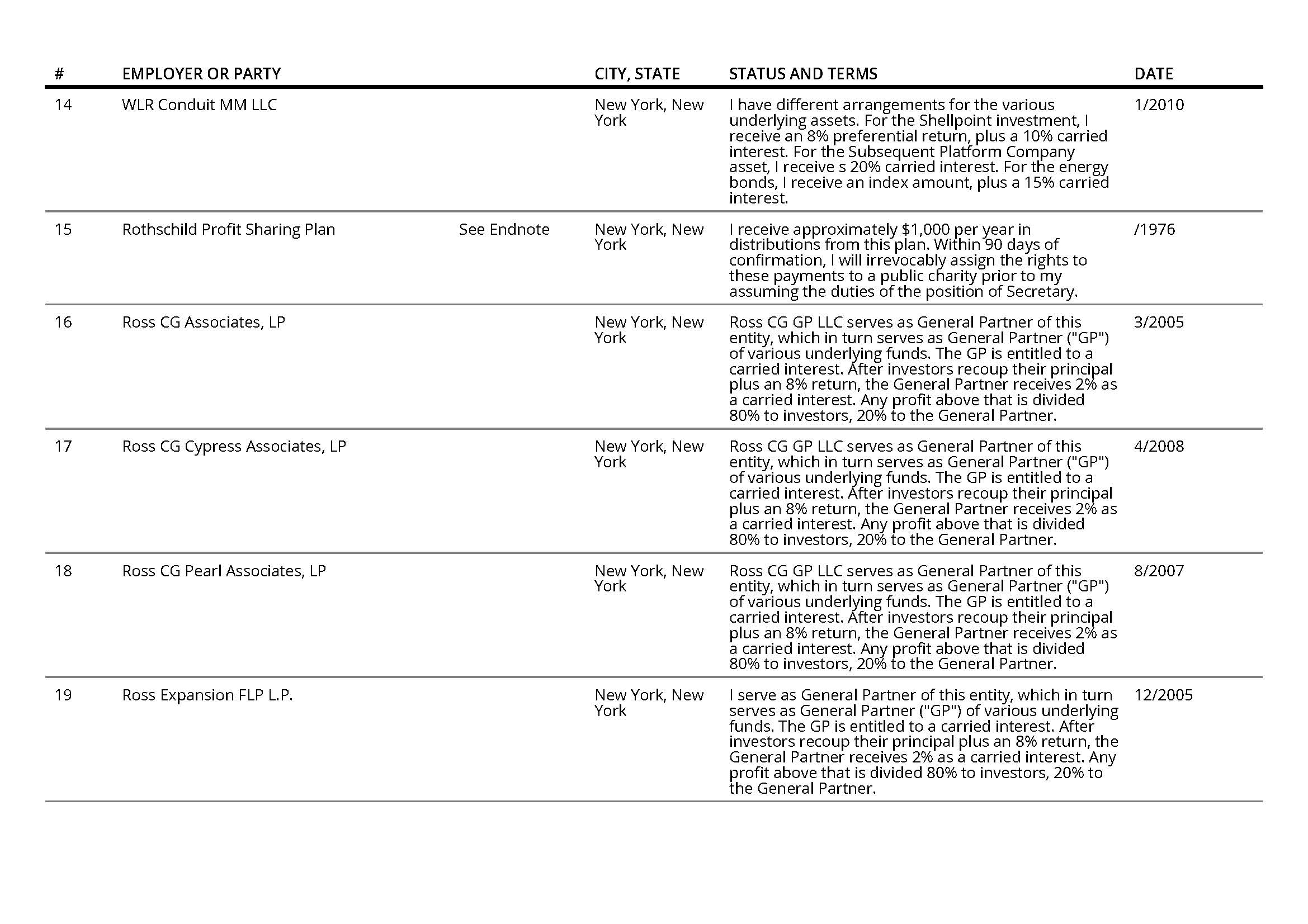

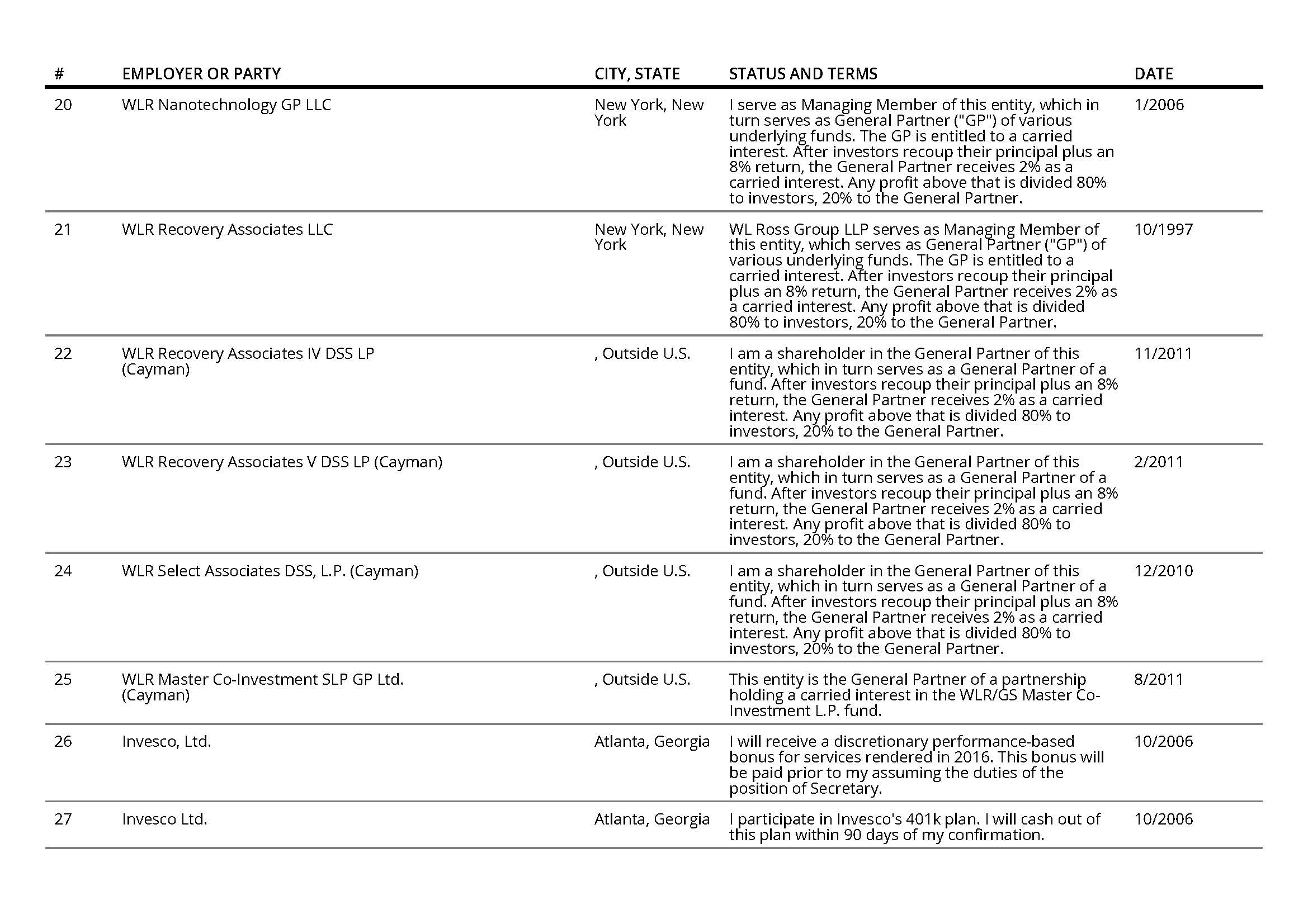

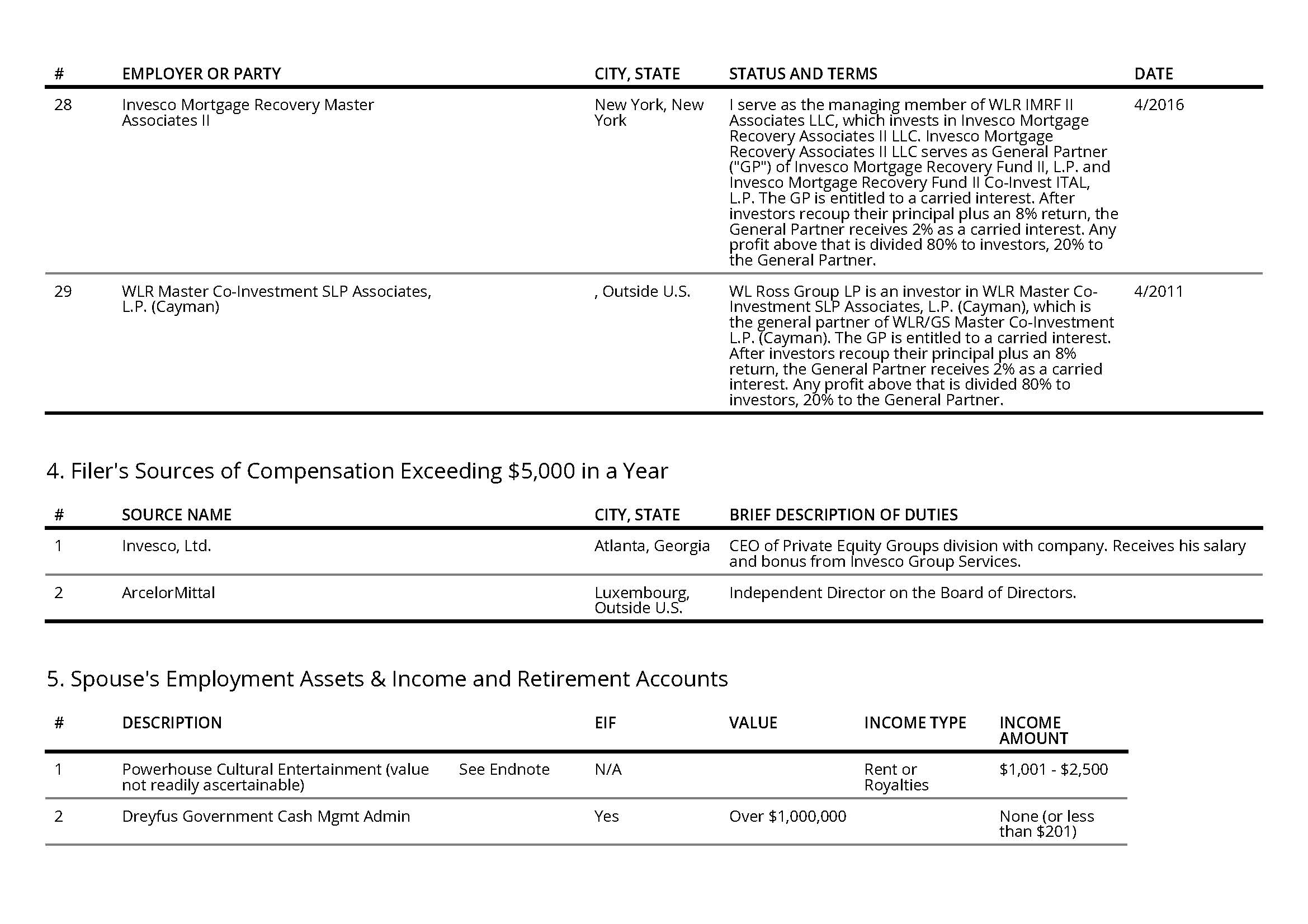

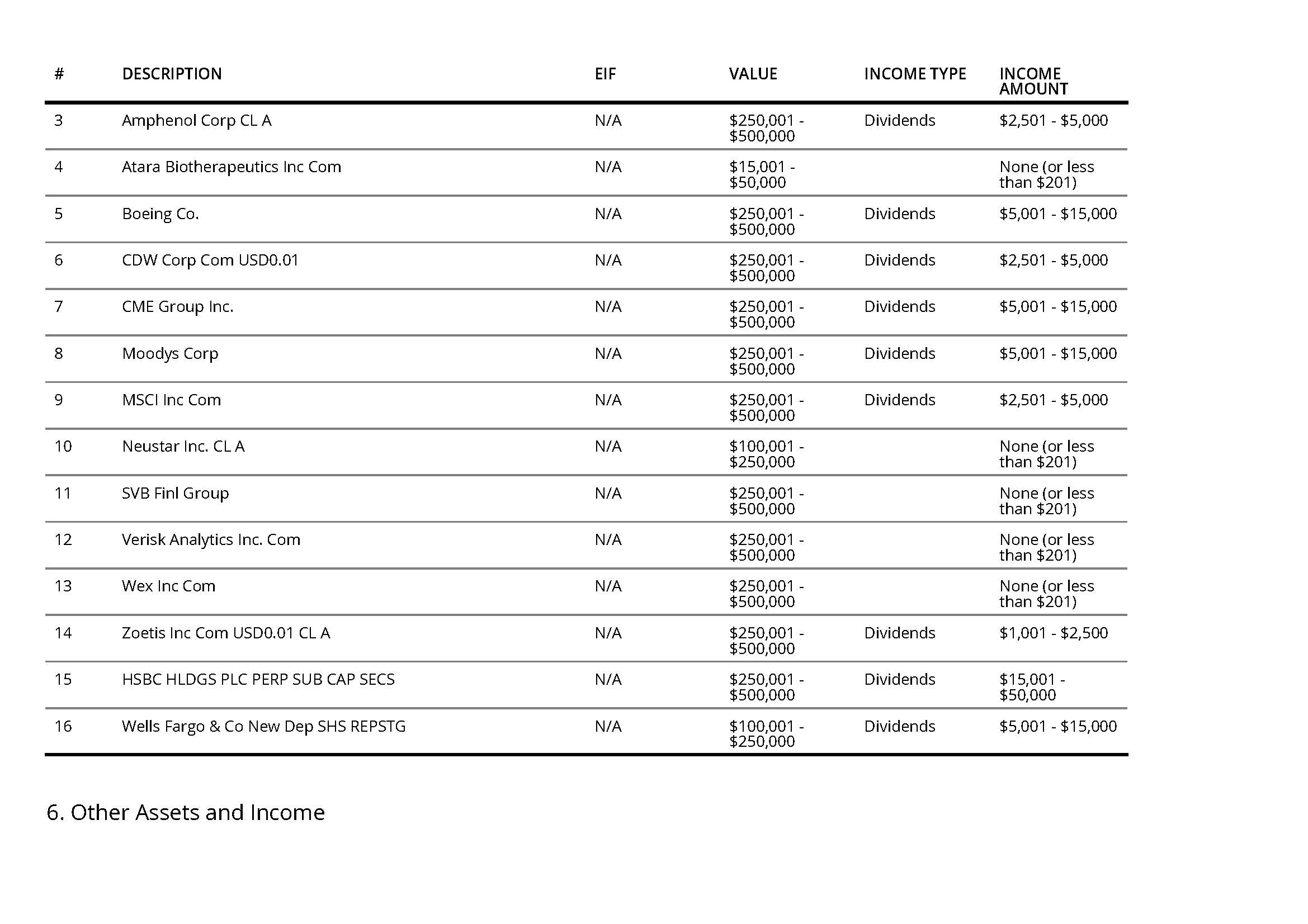

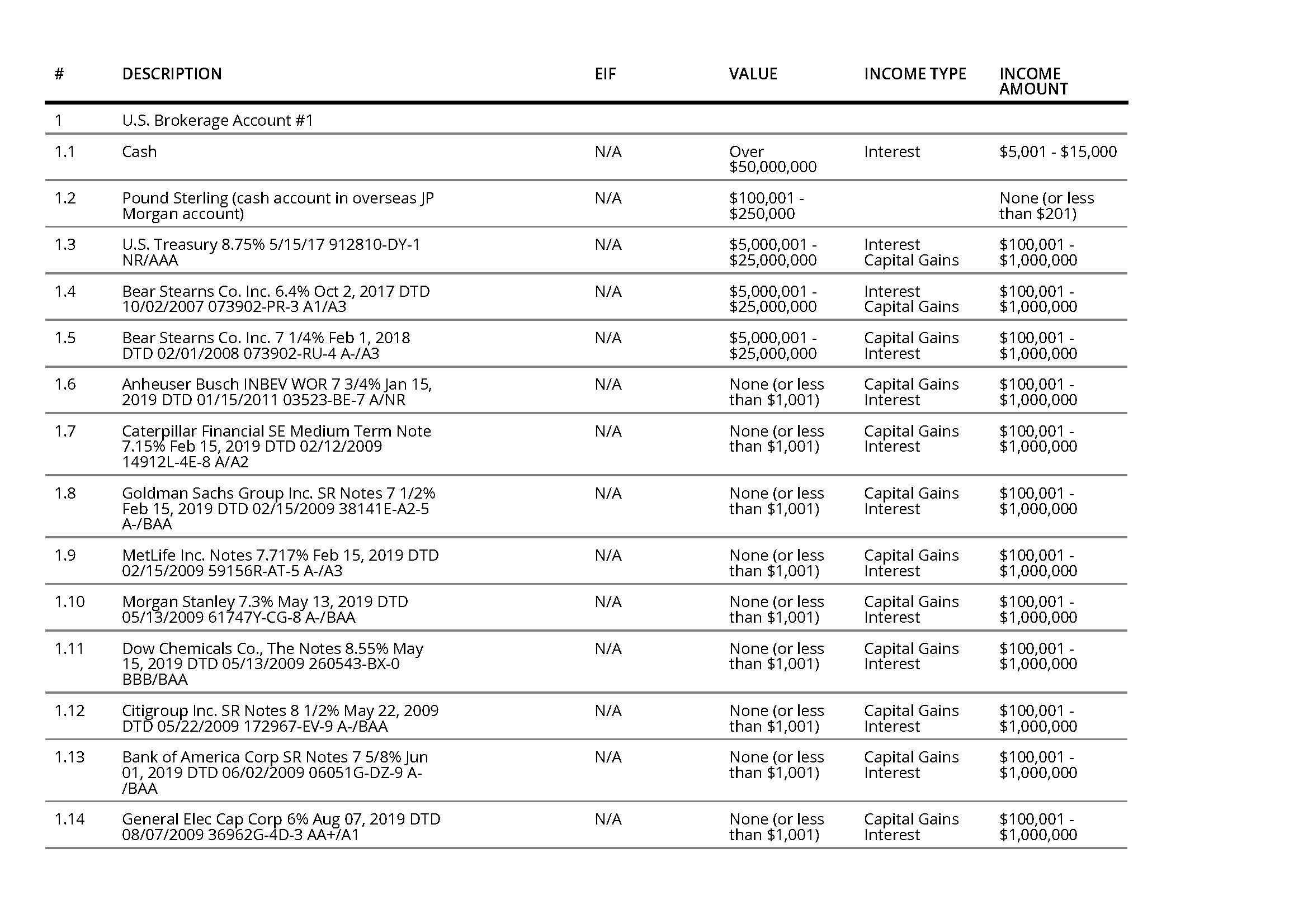

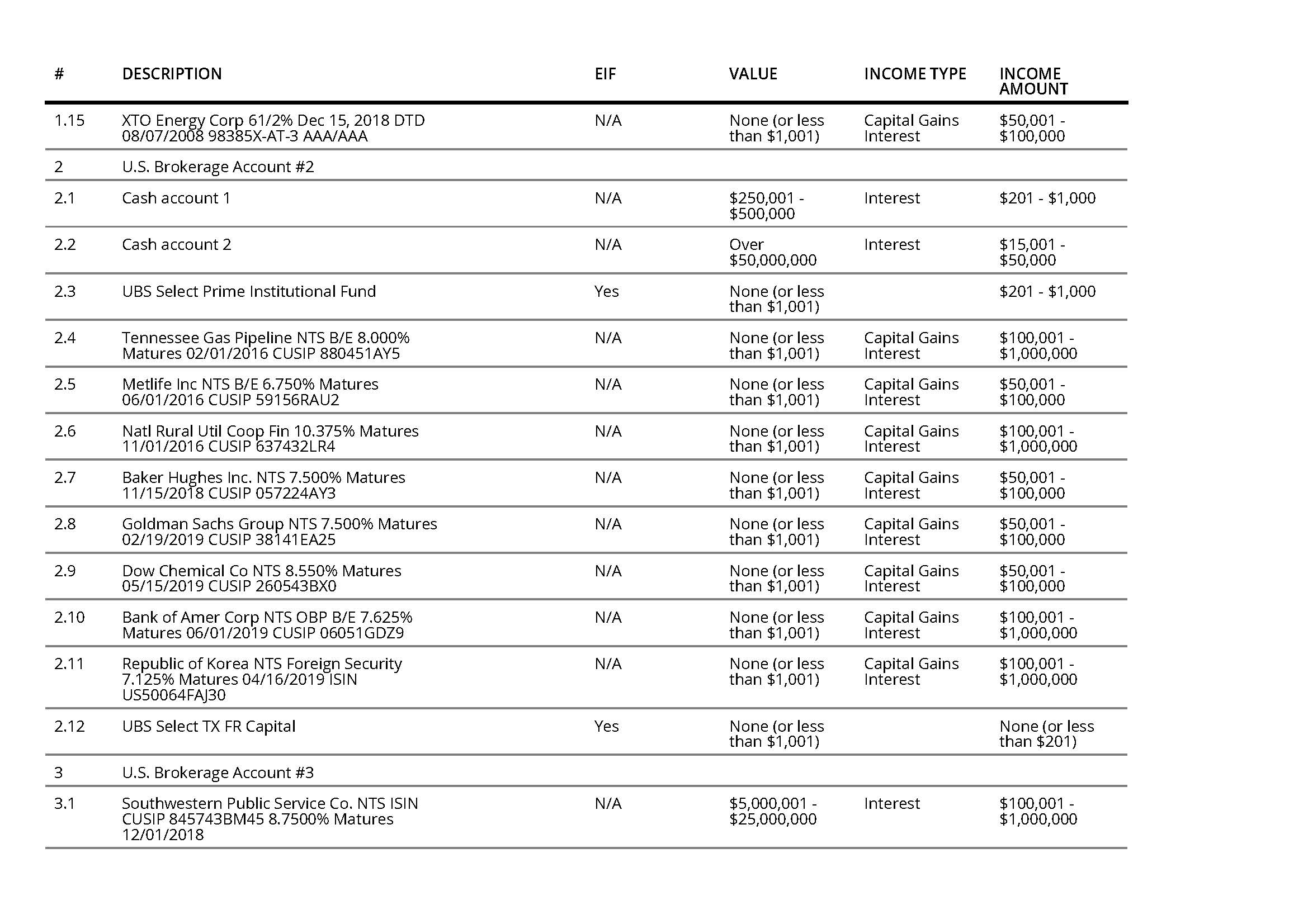

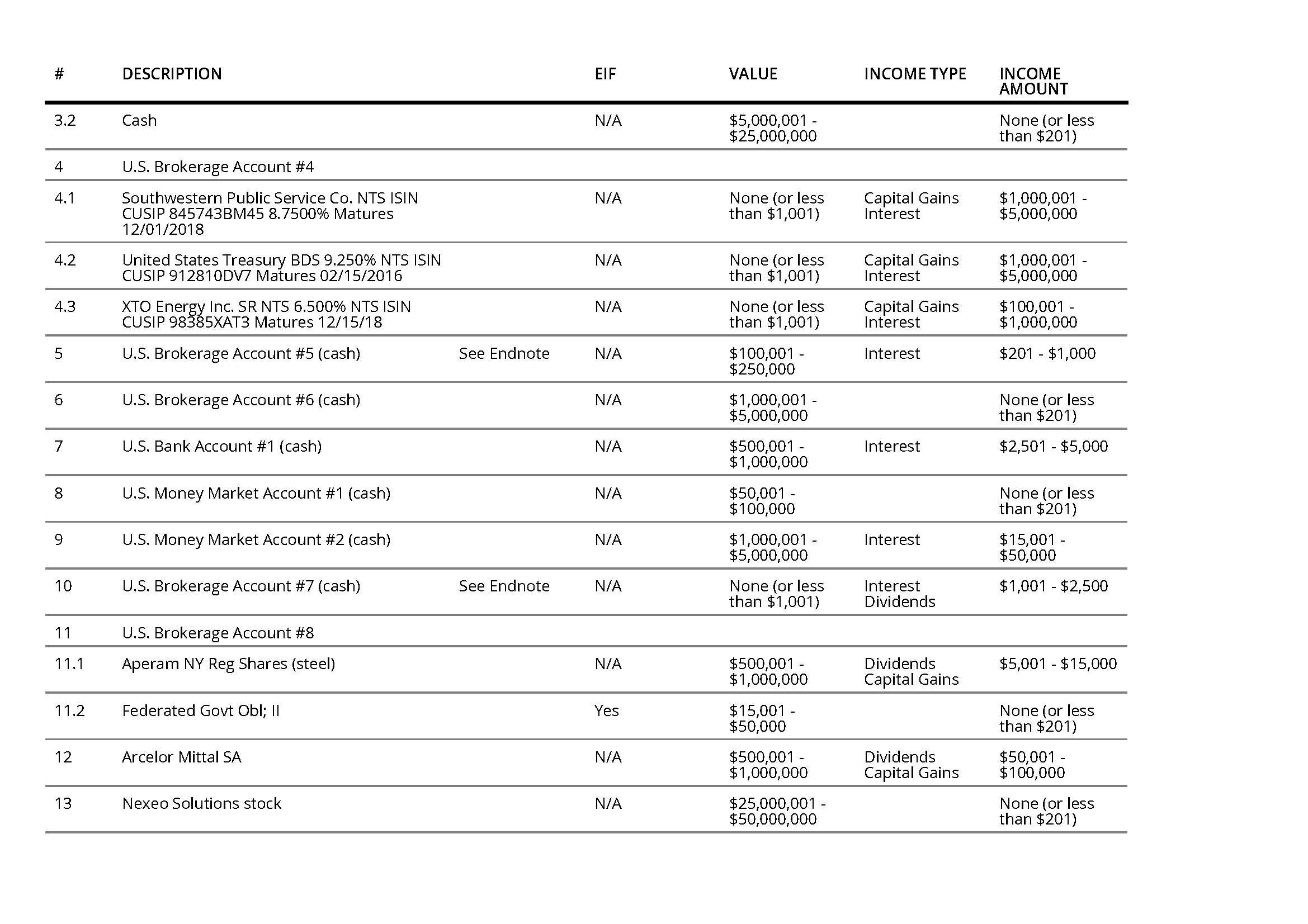

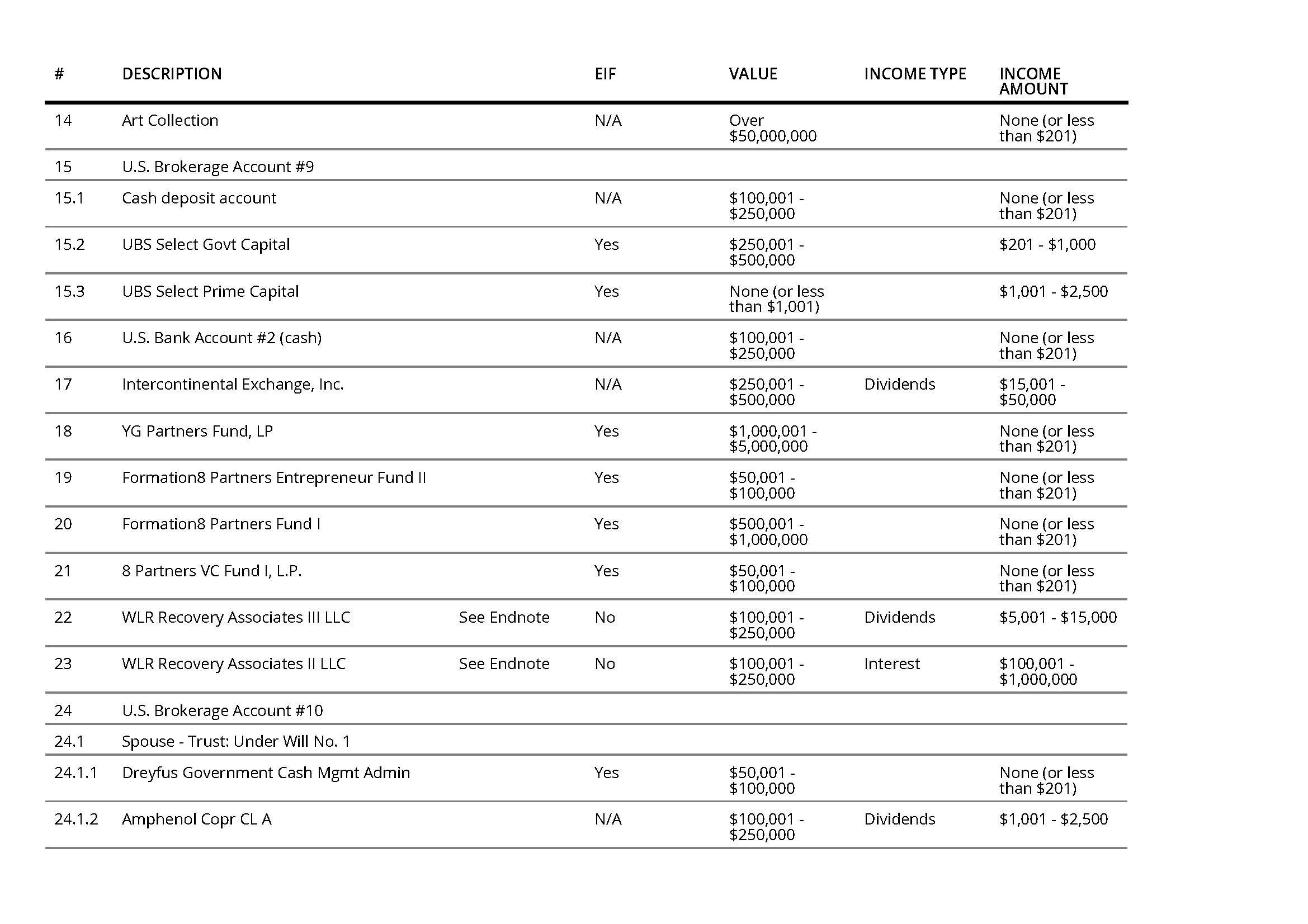

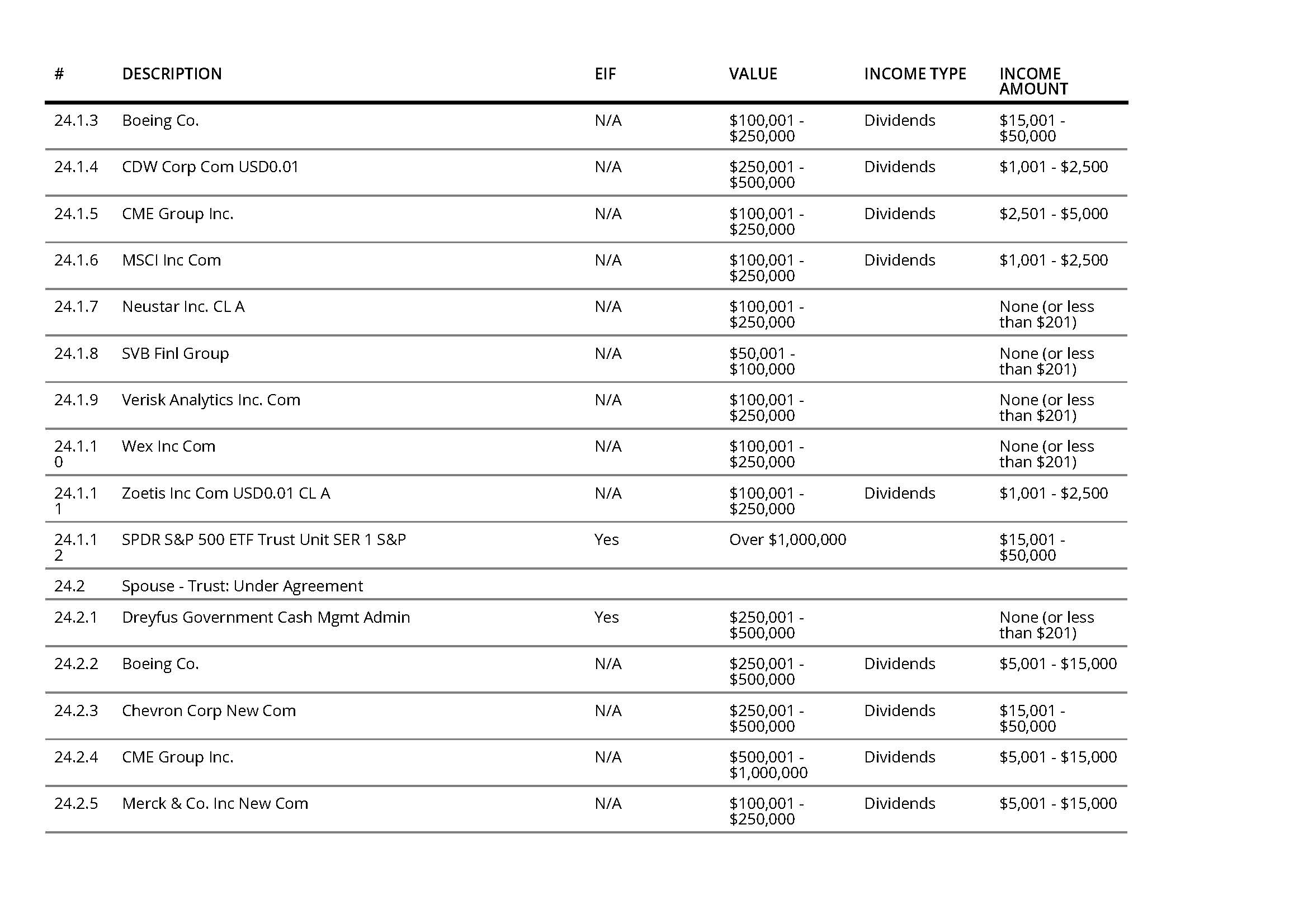

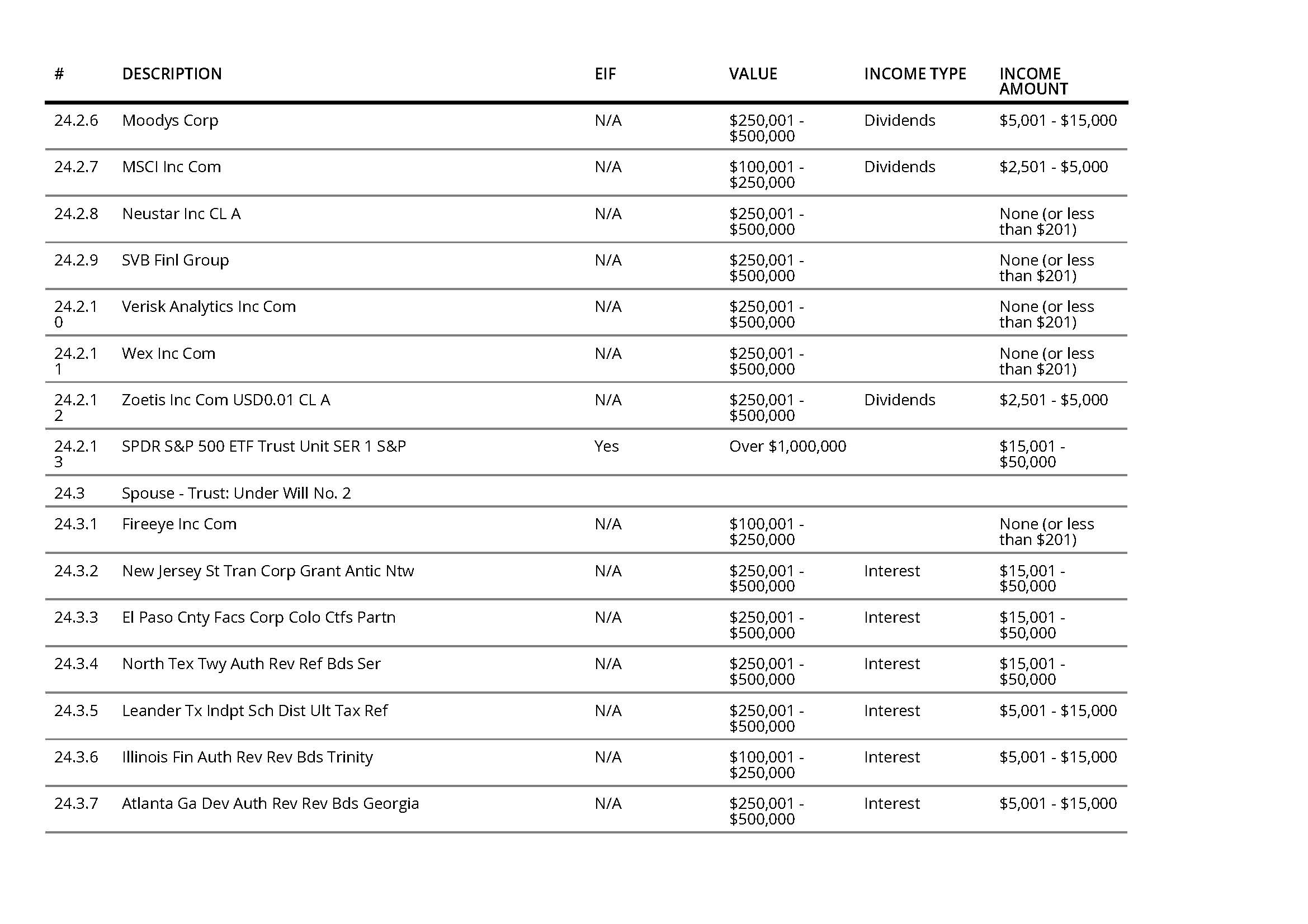

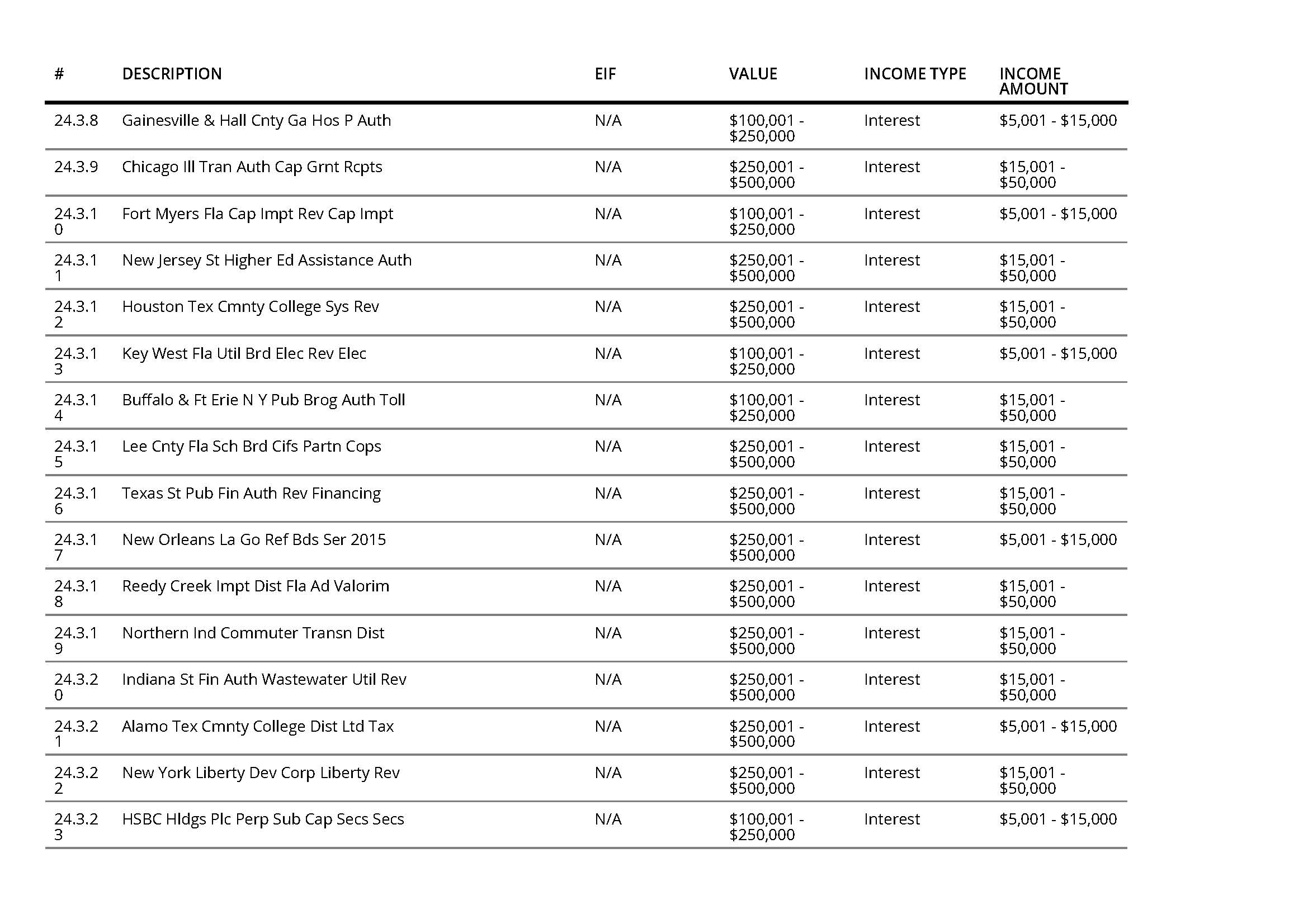

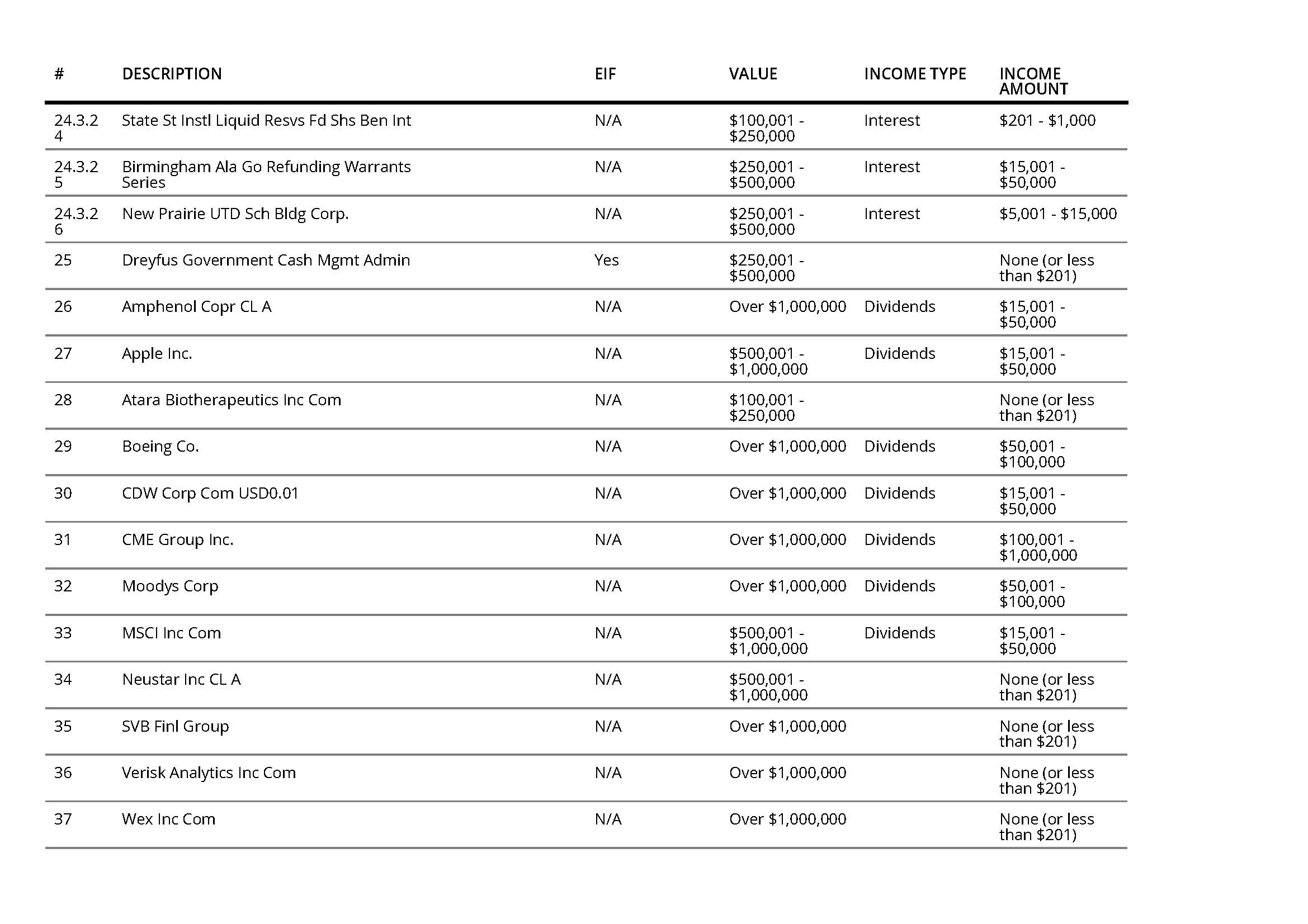

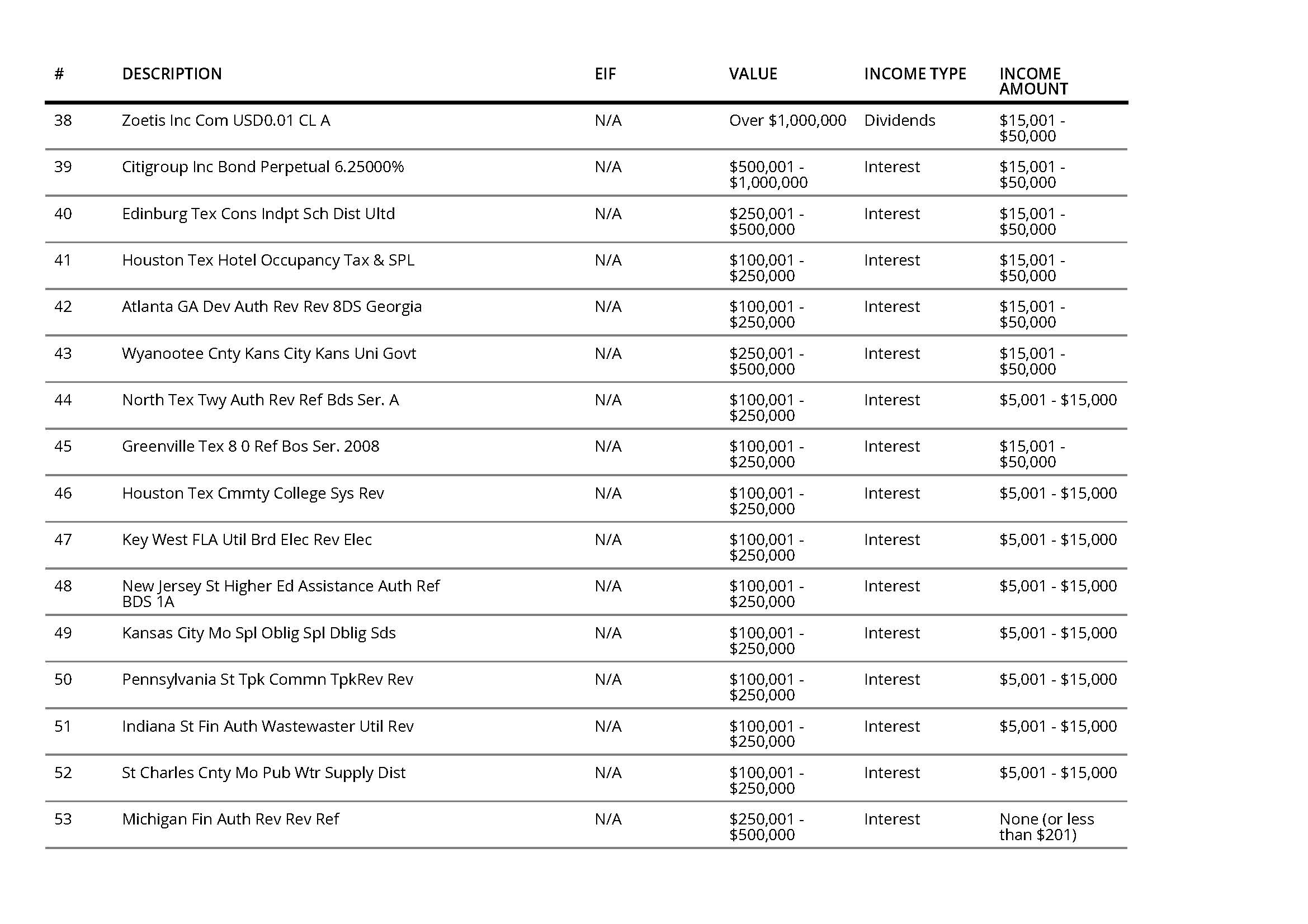

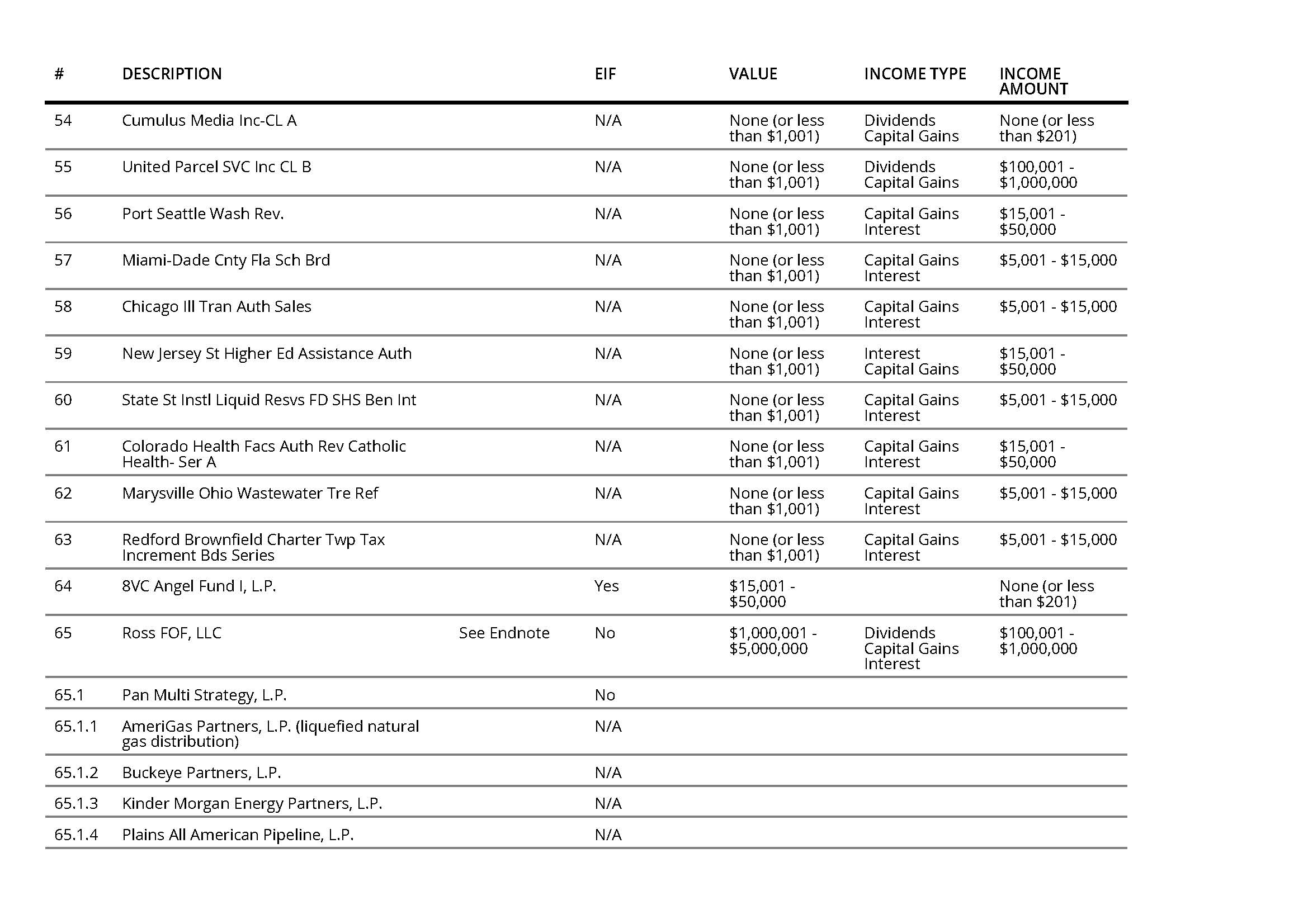

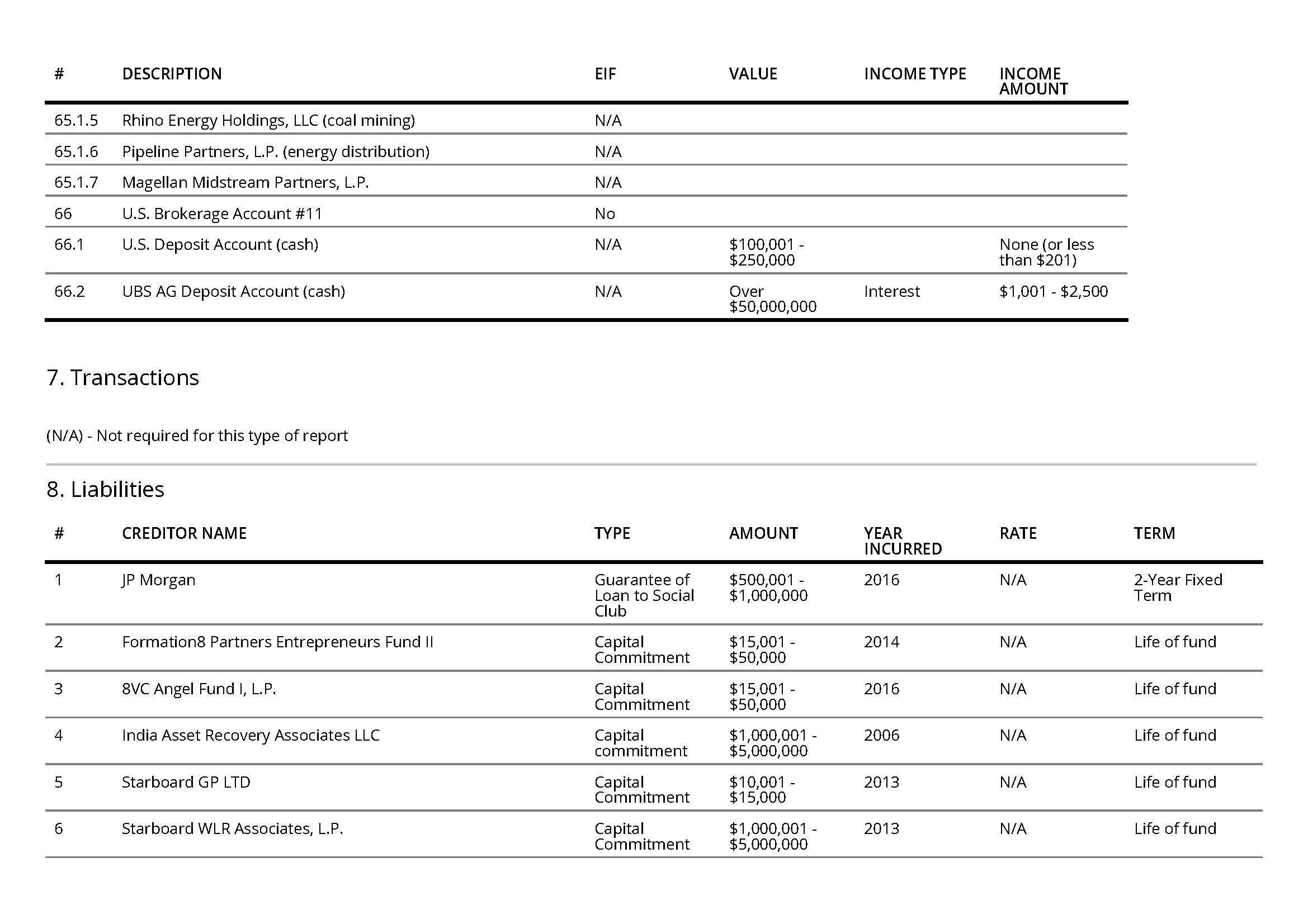

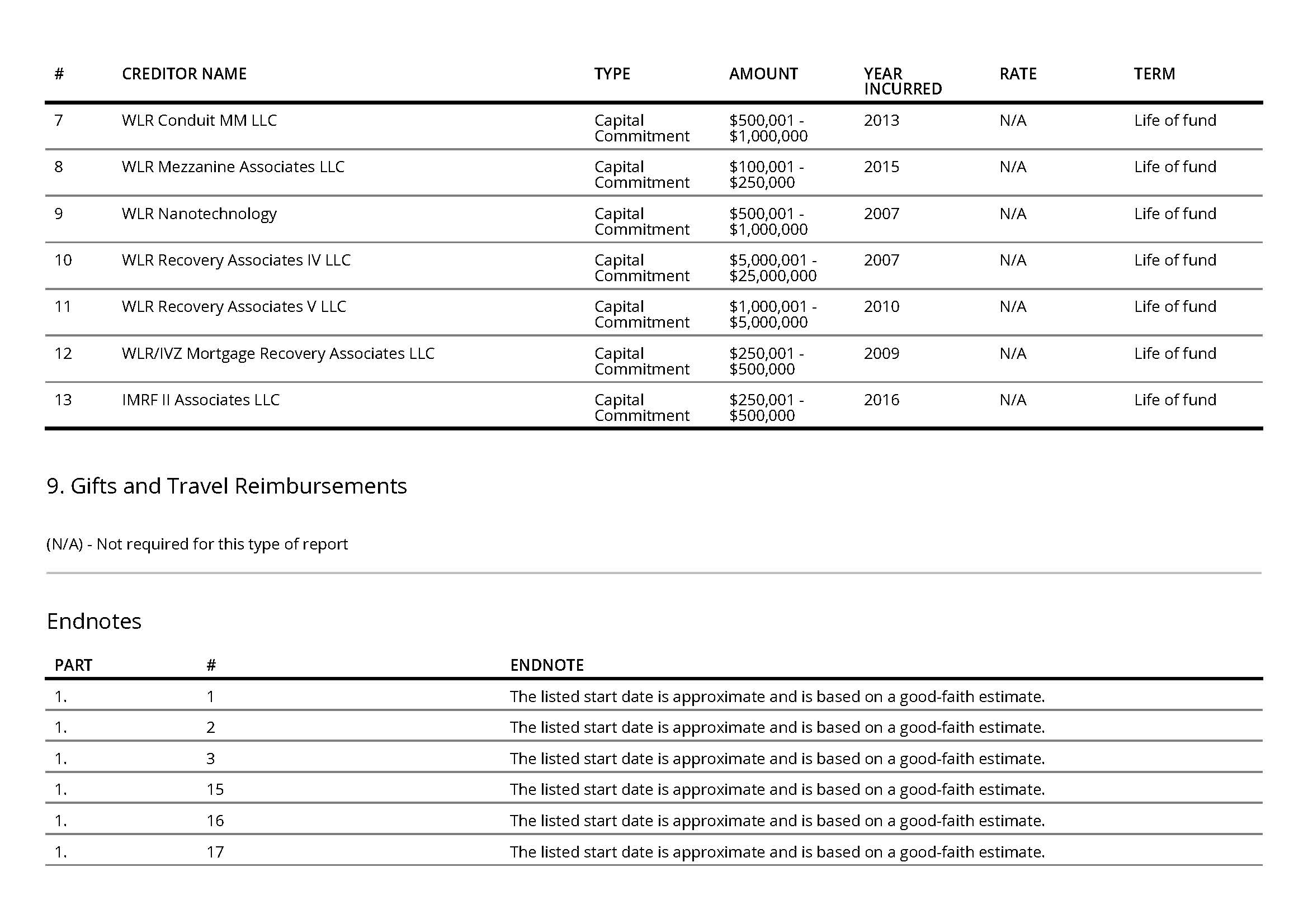

Under "Positions Held Outside United States Government," Ross lists 82. He is the director, chairman, or director/chairman of 56 entities, including WLR China Energy Associates, Huaneng Invesco, Sun National Bank, Bank of Cyprus, Bank of Ireland, International Automotive Group Japan, and India Asset Recovery Fund Limited. A whole lot of his corporations are headquartered in Delaware and the Cayman Islands. The section for his employment assets, income, and retirement accounts has more than 370 entries. And the section for other assets and income has over 170 more entries. Ross has $136 million in liquid cash. And an art collection worth over $50 million.

P.S.: Here's the OGE's warning that accompanies these disclsoures:

Title 1 of the Ethics in Government Act of 1978, as amended, 5 U.S.C. app. § 105(c), states that: 1. It shall be unlawful for any person to obtain or use a report: (A) for any unlawful purpose; (B) for any commercial purpose, other than by news and communications media for dissemination to the general public; (C) for determining or establishing the credit rating of any individual; or (D) for use, directly or indirectly, in the solicitation of money for any political, charitable, or other purpose. 2. The Attorney General may bring a civil action against any person who obtains or uses a report for any purpose prohibited in paragraph (1) of this subsection. The court in which such action is brought may assess against such person a penalty in any amount not to exceed $11,000. Such remedy shall be in addition to any other remedy available under statutory or common law.